I often get asked this question – should I do lump sum investing or divide my capital into smaller amounts to invest in parts over the course of time? The latter is also known as dollar-cost averaging.

Lump sum investing is great if the market is rising and you put more capital to work early. Dollar cost averaging works better in a down trending market because you buy cheaper over time.

But we will never know for sure where the market is heading so we are not going to invest based on our unreliable predictions of market directions.

The more important question here is the timing of your investment capital.

If you receive a windfall or an inheritance, lump sum investing would be a more relevant option.

However, for most people, their investment capital is derived from their salaries, which is paid monthly. You can either save the excess and invest only when the capital becomes sizable or invest a smaller amount monthly.

Hence, I want to focus on the majority group and share how you can do monthly investment into REITs.

Why REITs?

Because I think they are very suitable investments for most investors for two main reasons.

Firstly, REITs give out regular dividends and it is more comforting to investors when they see cold hard cash being credited into their accounts. The dividend effect can cushion the volatility in the market and investors can stay invested longer. That’s what matters for compounding to work its magic.

Secondly, many investors love properties and REITs make these investments ‘affordable’. It is a business that most can understand and relate to, and that increases investors’ confidence and holding power.

The key thing about monthly investing is to watch out for commission costs. As you buy your REITs more regularly in smaller amounts, the transaction fees might not be worthwhile as they eat into your returns.

Hence, only choose a low-cost broker if you want to invest monthly.

Here are the 5 REITs which you can buy:

#1 – Keppel DC REIT (SGX:AJBU)

Keppel DC REIT is a rare and popular data centre REIT in Singapore. The share price hit a high of $3.04 in 2020 given the optimism in Covid-accelerated adoption of digitalisation. But that optimism died down in 2021 and the share price has been falling throughout the year and was $2.35 at the time of writing.

We explained 5 possible reasons for the fall in Keppel DC REIT’s share price and the expansion of its mandate to acquire NetCo means it is no longer a pure play for data centres.

That said, I am still positive about the long-term prospects of Keppel DC REIT and I believe the fall in share price is justifiable due to its overvaluation in 2020. Data centres are going to play a critical role in the infrastructure of our digital world, including the metaverse of the future. I expect Keppel DC REIT to acquire more data centres in the coming years and to grow into a globally diversified data centre play.

Currently, Keppel DC REIT has majority of its data centres in Singapore. This is an enviable position because there are no new data centres allowed in Singapore currently and whatever data centres currently existing here are hot properties. Keppel DC REIT could milk the situation by increasing the rent and they will still have tenants paying them.

Even after the share price has fallen, Keppel DC REIT isn’t exactly cheap. It is still trading at a P/B ratio of 2.06, slightly above its 5y average of 1.96.

Keppel DC REIT’s dividend yield is about 4.4% which is not particularly high for REITs but I find it acceptable since we should expect to pay a premium for data centres.

Dollar cost averaging is suitable for such situations whereby it is not obviously cheap enough for a lump sum investment, but more prudent to invest in bit by bit. You get to buy cheaper and more units if it goes down further. And if it goes up, you are vested to some degree too.

Despite being a relatively young REIT, it has delivered higher capital gains to early investors compared to other REITs that had gone public for a longer period.

#2 – Mapletree Industrial Trust (SGX:ME8U)

Mapletree Industrial Trust (MIT) has gone big on data centres, which now represent more than 50% of its assets!

I believe there is no going back to old-school factories and the focus will be on higher value industrial properties such as hi-tech buildings and data centres.

Mapletree Industrial Trust’s valuation isn’t as demanding as Keppel DC REIT’s. This is probably because the former has other industrial properties alongside its data centres. MIT is trading at a PB Ratio of 1.44, which is slightly below its 5-year average PB of 1.63.

In terms of dividends, MIT is giving a dividend yield of 4.9% which is not far from Keppel DC REIT. It used to give dividend yields of 7% and higher. But that was based on a portfolio of traditional industrial properties. With data centres, the value has gone up as well as its share price and hence the dividend yield has gone down. This is a good sign and not a bad one.

MIT has been listed for over 10 years, giving decent capital and dividend gains to its investors.

#3 – Ascendas REIT (SGX:A17U)

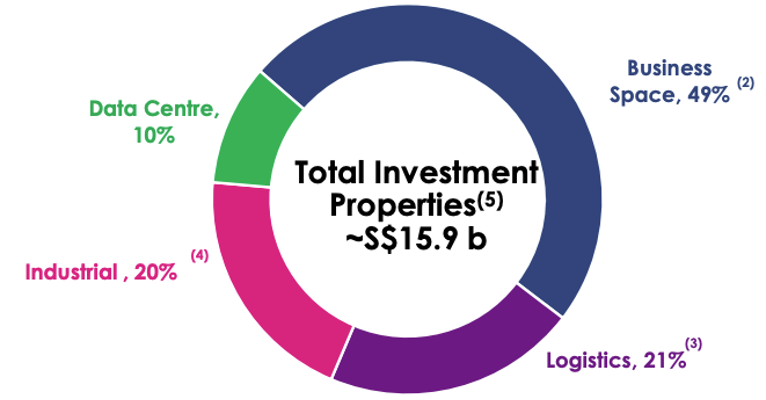

Ascendas REIT is the largest business space and industrial REIT listed on the Singapore Exchange. It has 11 data centres in Europe which represents 10% of the entire asset value.

The REIT has some big-name tenants such as Singtel, Sea, DBS, Stripe and Grab, so rental collection shouldn’t be an issue.

It is also advantageous to have CapitaLand as a sponsor as it ensures a steady pipeline of properties for acquisition.

Ascendas REIT is trading at a PB ratio of 1.3, which is equivalent to its 5-year average PB. It is fairly priced. Dividend yield is at 4.8%.

Ascendas REIT IPO-ed in 2005 and the share price has gained despite distributing dividends over the years.

#4 – Mapletree Logistics Trust (SGX:M44U)

Even though human mobility came to a standstill during Covid, logistics kept moving. We still need our supplies and the global logistics network delivered. Mapletree Logistics Trust (MLT) plays a role in the supply chain and tenants were able to contribute more rent to the REIT during a Covid year than ever before – revenue grew 14.3% for MLT while many other businesses struggled to even survive.

In 2021, the business improved further, revenue for the last 6 months grew by 24.4% compared to the previous year.

It is no surprise that the share price has done well. It hit an all-time high of $2.14 but has since retraced a little to below $2. It is currently trading at PB ratio of 1.4, which is above the 5-year average of 1.3.

Dividend yield is around 4%.

Zooming out to a 14-year period, we can see that the share price has risen steadily, delivering both capital gains and dividends to their unitholders.

#5 – Mapletree Commercial Trust (SGX:N2IU)

Office and retail demand on the other hand were not as resilient as the logistics properties since people could work from home and go to the malls less often. Mapletree Commercial Trust (MCT) saw a slight drop of 1.9% in its revenue during the Covid year.

But the results have rebounded in 1H FY21/22 with a revenue increase of 11.5%. It managed to weather the Covid impact and now the growth seems to be back on track.

MCT has 5 properties in the south of Singapore – VivoCity, Mapletree Business City, mTower (formerly PSA Building), Mapletree Anson and Bank of America Merrill Lynch HarbourFront.

The share price is currently trading at a PB multiple of 1.2, which is below its 5-year average PB of 1.3.

Dividend yield is at 4.6%.

Similar to the other REITs above, MCT’s share price has risen significantly since its inception and unitholders has enjoyed both dividend and capital gains over the long term.

Invest regularly into REITs that offer stable and sustainable gains

REITs are popular investments because of its regular dividends as well as the simple-to-understand business – they rent out properties.

However, not all REITs are created equal. I have shared 5 REITs which have exhibited their quality – we can see the steady growth in their share prices and the consistent dividends delivered over a long period of time.

These steadily compounding REITs are great for regular investments which you can use to build up your portfolio little by little. Slowly but surely.

You will need a low-cost brokerage to invest small amounts each time. Phillip Futures‘ fee of 0.08% with no minimum fee is one of the lowest in Singapore.