Updated: 27 Oct 2021

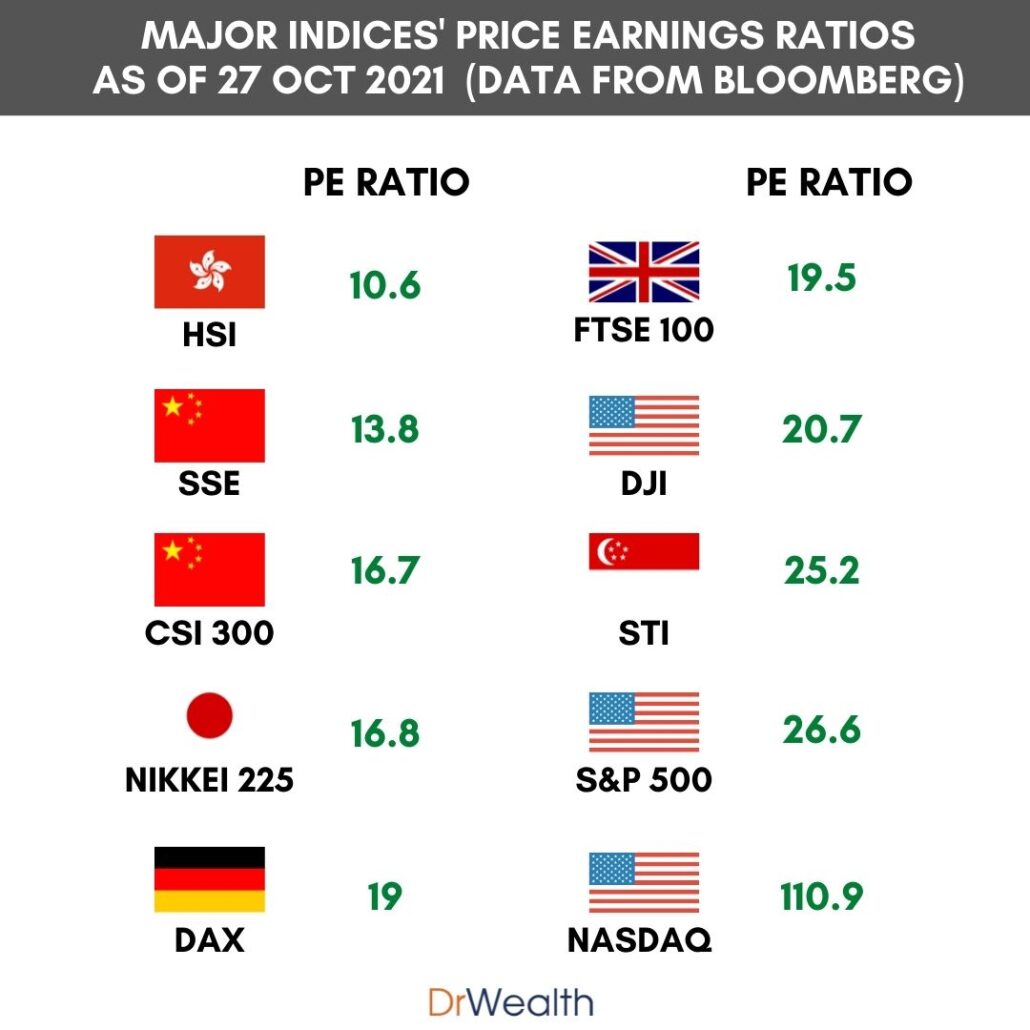

Hong Kong stocks remain are the cheapest in the world, way cheaper than Singapore stocks, if we compare the indices by their PE ratios.

The blue chips in Hong Kong are represented by the 50 constituents in the Hang Seng Index (HSI).

In this article, we will list these Hong Kong blue chips that are paying a dividend yield of more than 4%.

This list is created with historical data and is meant to provide some trade ideas for you to think about. They are NOT recommendations. Please do further research before making any investment decision. Avoid investing when in doubt.

#26 – China Light and Power Company (SEHK:2): 4.11%

- Data as of 27 Oct 2021

- Based on share price of HK75.35

- Dividend Yield: 4.11%

- PE Ratio: 16.63

- PB Ratio: 1.7

China Light and Power Company (CLP Holdings Ltd) engages in the generation and supply of electricity. The firm operates through the following geographical segments: Hong Kong, Mainland China, India, Southeast Asia and Taiwan and Australia. It offers retail services in Hong Kong and Australia. The company was founded on October 24, 1997 and is headquartered in Hong Kong.

#25 – Hang Lung Properties (SEHK:101): 4.15%

- Data as of 27 Oct 2021

- Based on share price of HK18.32

- Dividend Yield: 4.15%

- PE Ratio: 37.4

- PB Ratio: 0.6

Hang Lung Properties Ltd. engages in property investment for rental income, property development for sales and leasing, car park management, and property management through its subsidiaries. It operates through the Property Leasing and Property Sales segments. The Property Leasing segment includes property leasing operation in investment properties, such as retail, office, residential, serviced apartments and carparks in mainland China and Hong Kong. The Property Sales segment includes development and sale of the Group’s trading properties in Hong Kong.

Prefer to invest in Singapore companies listed in Hong Kong? Read this.

#24 – Link REIT (SEHK:823): 4.23%

- Data as of 27 Oct 2021

- Based on share price of HK68.6

- Dividend Yield: 4.23%

- PE Ratio: 120.35

- PB Ratio: 0.9

Link Real Estate Investment Trust engages in property development and related activities. The firm operates through the following segments: Retail Properties, Car Parks and Others. Its investment properties include destination and community shopping centers, offices, fresh markets and corporate avenue. The company was founded on June 9, 2005 and is headquartered in Hong Kong.

You can also get exposure to Link REIT via the NikkoAM-Straits Trading Asia Ex-Japan REIT ETF.

#23 – Ping An (SEHK:2318): 4.36%

- Data as of 27 Oct 2021

- Based on share price of HK60.15

- Dividend Yield: 4.36%

- PE Ratio: 6.23

- PB Ratio: 1.21

Ping An Insurance (Group) Co. of China Ltd. engages in the provision of financial products and services. It operates through the following segments: Insurance, Banking, Trust, Securities, Other Asset Management, Technology, and Others. The Insurance segment offers life, property and casualty, pension, and health insurance services. The Banking segment undertakes loan and intermediary business, wealth management, and credit card services. The Trust segment provides trust services and undertakes investing activities. The Securities segment undertakes brokerage, trading, investment banking and asset management services. The Other Asset Management business segment provides investment management services and financial leasing business, reflecting the performance of asset management and financial leasing and the other asset management subsidiaries. The Technology business segment provides financial and daily-life services through internet platforms such as financial transaction information service platform, health care service platform, reflecting performance summary of the technology business subsidiaries, associates and jointly controlled entities. The company was founded by Ming Zhe Ma on March 21, 1988 and is headquartered in Shenzhen, China.

Ping An was performing well before the latest regulatory hits in China as well as a major natural disaster. These could be short term hurdles in their business, we analysed Ping An’s fundamentals here.

#22 – CK Hutchison (SEHK:1): 4.4%

- Data as of 27 Oct 2021

- Based on share price of HK$52.55

- Dividend Yield: 4.4%

- PE Ratio: 6.95

- PB Ratio: 0.41

CK Hutchison Holdings Ltd. is an investment holding company, which engages in the development, innovation, operation and investment in different business sectors. It operates through the following segments: Ports and Related Services; Retail; Infrastructure; Husky Energy and Telecommunications.

#21 – Longfor Group (SEHK:960): 4.46%

- Data as of 27 Oct 2021

- Based on share price of HK$38.20

- Dividend Yield: 4.46%

- PE Ratio: 9.40

- PB Ratio: 1.79

Longfor Group Holdings Ltd. engages in real estate development. The company operates through the following segments: Property Development, Property Investment, and Property Management and Related Services. The Property Development segment develops and sells office premises, commercial, and residential properties. The Property Investment segment leases investment properties. The Property Management and Related Services segment engages in property management business. The company was founded in 1993 and is headquartered in Beijing, China.

#20 – China Resource Land (SEHK:1109): 4.72%

- Data as of 27 Oct 2021

- Based on share price of HK$31.60

- Dividend Yield: 4.72%

- PE Ratio: 6.34

- PB Ratio: 0.93

China Resources Land Ltd. engages in the investment and management of real estate properties. It operates through the following segments: Development of Properties for Sale; Property Investments and Management; Hotel Operations; and Construction, Decoration Services and Others. The company was founded in 1994 and is headquartered in Hong Kong.

#19 – Sun Hung Kai Properties (SEHK:16): 4.84%

- Data as of 27 Oct 2021

- Based on share price of HK$102.2

- Dividend Yield: 4.84%

- PE Ratio: 11.1

- PB Ratio: 0.5

Sun Hung Kai Properties Ltd. engages in the development of property for sale and investment. It operates through the following segments: Property Development, Property Investment, Hotel Operation, Telecommunications and Transport Infrastructure and Logistics.

#18 – China Unicom (SEHK:762): 4.86%

- Data as of 27 Oct 2021

- Based on share price of HK$24.80

- Dividend Yield: 4.86%

- PE Ratio: 8.23

- PB Ratio: 0.32

China Unicom (Hong Kong) Ltd. engages in the provision of voice usage, broadband and mobile data services, and data and internet application services through its subsidiaries. It also offers other value-added services, leased lines and associated services, and sales of telecommunications products. The company was founded on February 8, 2000 and is headquartered in Hong Kong.

#17 – BOC Hong Kong (SEHK:2388): 5.01%

- Data as of 27 Oct 2021

- Based on share price of HK$24.80

- Dividend Yield: 5.04%

- PE Ratio: 9.9

- PB Ratio: 0.9

BOC Hong Kong (Holdings) Ltd. engages in the provision of banking and related financial services. It operates through the following segments: Personal Banking, Corporate Banking, Treasury, Insurance, and Others. The Personal Banking and Corporate Banking segments provide offers general banking services, including various deposit products, overdrafts, loans, credit cards, trade related products and other credit facilities, investment and insurance products, and foreign currency and derivative products. The Treasury segment manages the funding and liquidity, and the interest rate and foreign exchange positions of the group in addition to proprietary trades. The Insurance segment focuses on long-term life insurance products, including traditional and investment-linked individual life insurance and group life insurance products. The Others segment relates to the firm’s holdings of premises, investment properties, equity investments and interests in associates and joint ventures.

#16 – CNOOC (SEHK:883): 5.31%

- Data as of 27 Oct 2021

- Based on share price of HK$8.47

- Dividend Yield: 5.31%

- PE Ratio: 12.69

- PB Ratio: 0.73

CNOOC Ltd. engages in the exploration, development, production, and sale of crude oil, natural gas, and other petroleum products through its subsidiaries. It operates through the following segments: Exploration and Production, Trading Business, and Corporate. Its core operations areas is comprised of Bohai, Western South China Sea, Eastern South China Sea, East China Sea, Asia, Africa, North America, South America, Oceania, and Europe.

#15 – Petrochina (SEHK:857): 5.36%

- Data as of 27 Oct 2021

- Based on share price of HK$3.89

- Dividend Yield: 5.36%

- PE Ratio: 32.64

- PB Ratio: 0.49

PetroChina Co. Ltd. engages in the petroleum-related products, services and activities. It operates through the following business segments: Exploration and Production; Refining and Chemicals; Marketing; Natural Gas and Pipeline; and Head Office and Other. The Exploration and Production segment involves exploration, development, production, and marketing of crude oil and natural gas. The Refining and Chemicals segment focuses on the refining of crude oil and petroleum products, production and marketing of primary petrochemical products, derivative petrochemical products, and other chemical products. The Marketing segment includes marketing of refined products and the trading business. The Natural Gas and Pipeline segment comprises transmission of natural gas, crude oil, and refined products and the sale of natural gas. The Head Office and Other segment relates to cash management and financing activities, the corporate center, research and development, and other business services supporting the operating business segments of the Group.

#14 – China Life Insurance (SEHK:2628): 5.4%

- Data as of 27 Oct 2021

- Based on share price of HK$14.12

- Dividend Yield: 5.4%

- PE Ratio: 6.69

- PB Ratio: 0.74

China Life Insurance Co., Ltd. engages in the provision of life, annuity, accident, and health insurance. It operates through the following segments: Life Insurance Businesses, Health Insurance Businesses, Accident Insurance Businesses, and Other Businesses. The Life Insurance Businesses segment involves in the sale of life insurance policies, including those life insurance policies without significant insurance risk transferred. The Health Insurance Businesses segment offers health insurance policies, including those health insurance policies without significant insurance risk transferred. The Accident Insurance Businesses segment relates to the sale of accident insurance policies. The Other Businesses includes income and allocated cost of insurance agency businesses.

#13 – CK Infrastructure (SEHK:1038): 5.43%

- Data as of 27 Oct 2021

- Based on share price of HK$45.5

- Dividend Yield: 5.43%

- PE Ratio: 15.64

- PB Ratio: 1.08

CK Infrastructure Holdings Ltd. is an investment company, which engages in the development, investment, and construction of power plants, industrial buildings, and other infrastructure facilities. It operates through the followign segments: Investment in Power Assets, Infrastructure Investments, and infrastructure Related Business. It includes energy infrastructure, transportation infrastructure, water infrastructure, and commercialization of infrastructure related business.

#12 – Henderson Land (SEHK:12): 5.6%

- Data as of 27 Oct 2021

- Based on share price of HK$32.15

- Dividend Yield: 5.6%

- PE Ratio: 15.24

- PB Ratio: 0.48

Henderson Land Development Co. Ltd. engages in property development and investment, construction, infrastructure, hotel operation, finance, department store operation, and project management. It operates through the following business segments: Property Development; Property Leasing; Department Store Operation; Others Businesses; and Utility and Energy. The Property Development segment involves in the development and sale of properties. The Property Leasing segment offers leasing of properties. The Department Store Operation segment comprises of department store operations and management. The Other Businesses segment is comprised of hotel operation and management, construction, provision of finance, investment holding, project management, property management, agency services, cleaning and security guard services, as well as the trading of building materials and disposal of leasehold land. The Utility and Energy segment consists of production, distribution and marketing of gas, water supply, and energy businesses.

#11 – New World Development (SEHK:17): 6.06%

- Data as of 27 Oct 2021

- Based on share price of HK$34

- Dividend Yield: 6.06%

- PE Ratio: 73.91

- PB Ratio: 0.39

New World Development Co. Ltd. engages in the property development and investment businesses. It operates through the following business segments: Property Development, Property Investment, Service and Infrastructure, Hotel Operations, Department Stores and Others. The Property Development segment focuses on the residential usage of company properties in China and Hong Kong. The Property Investment segment handles lands and buildings that are for lease or rent. The Service segment comprises of facilities management, contracting and transport, and strategic investments. The Infrastructure segment includes the development of roads and ports, and energy, water and logistics projects. The Hotel Operations segment manages major hotel projects in Hong Kong, namely, Grand Hyatt Hong Kong, Hyatt Regency Hong Kong, Tsim Sha Tsui, Hyatt Regency Hong Kong, Sha Tin and Renaissance Harbour View Hotel. The Department Store segment operates department store retail chain in China. The Others segment includes media and technology businesses.

#10 – Power Assets (SEHK:6): 6.09%

- Data as of 27 Oct 2021

- Based on share price of HK$46.15

- Dividend Yield: 6.09%

- PE Ratio: 16.08

- PB Ratio: 1.16

Power Assets Holdings Ltd. engages in the generation, transmission, and distribution of electricity. It operates through the following segments: Investments in Hong Kong Electric Investments (HKEI), Investments, and All Other Activities. The Investments in HKEI segment invests in the generation and supply of electricity business in Hong Kong. The Investments segment includes investment in energy and utility-related businesses, and is segregated further into the geographical segments such as the United Kingdom, Australia, Mainland China, and other regions. The All Other Activities segment represents other businesses carried out by the group.

#9 – CITIC (SEHK:267): 6.12%

- Data as of 27 Oct 2021

- Based on share price of HK$7.97

- Dividend Yield: 6.12%

- PE Ratio: 4.09

- PB Ratio: 0.34

CITIC Ltd. engages in finance, energy, engineering, manufacturing, and real estate businesses. It operates through the following segments: Financial Services, Resources and Energy, Manufacturing, Engineering Contracting, Real Estate, and Other Businesses. The Financial Services spans the banking, trust, asset management, securities and insurance services. The Resources and Energy segment comprises of the exploration, processing, and trading of resources and energy products, including crude oil, coal, and iron ore. The Manufacturing segment includes manufacturing of special steels, heavy machineries, aluminium wheels, and other products. The Engineering Contracting segment involves contracting and design services for infrastructure, real estate, and industrial projects, etc. The Real Estate segment manages the development, sale and holding of properties. The Other Businesses segment focuses on investment and operation of infrastructures, telecommunication services, motor and food and consumer products business, commercial aviation services, publication services, and others.

#8 – SINOPEC (SEHK:386): 6.26%

- Data as of 27 Oct 2021

- Based on share price of HK$3.81

- Dividend Yield: 6.26%

- PE Ratio: 11.71

- PB Ratio: 0.52

Sinopec Corp aka China Petroleum & Chemical Corp. engages in the exploration, development and production of crude oil and natural gas. It operates through the following segments: Exploration and Production; Refining; Marketing and Distribution; Chemicals; and Corporate and Others. The Exploration and Production segment consists of activities related to exploring for and developing, producing, and selling crude oil and natural gas. The Refining segment purchases crude oil from its exploration and production segment and from third parties, processing of crude oil into refined oil products, and selling refined oil products principally to its marketing and distribution segment. The Marketing and Distribution segment includes refined oil products from its refining segment and third parties, and marketing, selling and distributing refined oil products by wholesale to large customers and independent distributors, and retail through its retail network. The Chemicals segment focuses on chemical feedstock principally from the refining segment and producing, marketing, selling, and distributing chemical product. The Corporate and Others segment comprises of trading activities of the import and export subsidiaries, and its research and development activities.

#7 – China Overseas (SEHK:688): 6.71%

- Data as of 27 Oct 2021

- Based on share price of HK$17.58

- Dividend Yield: 6.71%

- PE Ratio: 3.68

- PB Ratio: 0.51

China Overseas Land & Investment Ltd. engages in the provision of finance, treasury, and management services. The company operates its business through the following segments: Property Development, Property Investment and Other Operations. The Property Development segment involves in property development activities. The Property Investment segment offers property rentals. The Other Operations segment comprises of real estate agency and management services; and construction and building design consultancy services. The company was founded in 1979 and is headquartered in Hong Kong.

#6 – China Mobile (SEHK:941): 6.76%

- Data as of 27 Oct 2021

- Based on share price of HK$48.65

- Dividend Yield: 6.76%

- PE Ratio: 7.75

- PB Ratio: 0.73

China Mobile Ltd. operates as an investment holding company. It provides telecommunications and other related services in Mainland China. The firm offers communications services in all 31 provinces, autonomous regions and directly-administered municipalities throughout Mainland China and in Hong Kong Special Administrative Region. Its Internet Protocol based core network is capable of supporting the GSM, TD-SCDMA, TD-LTE and LTE FDD networks.

#5 – Country Garden (SEHK:2007): 7.14%

- Data as of 27 Oct 2021

- Based on share price of HK$7.60

- Dividend Yield: 7.14%

- PE Ratio: 3.94

- PB Ratio: 0.8

Country Garden Holdings Co. Ltd. engages in the real estate business. It operates through the following segments: Property Development; Construction; Property Investment; Property Management; and Hotel Operation.

#4 – China Construction Bank (SEHK:939): 7.26%

- Data as of 27 Oct 2021

- Based on share price of HK$4.32

- Dividend Yield: 7.26%

- PE Ratio: 4.21

- PB Ratio: 0.46

China Construction Bank Corp. engages in the provision of a wide range of financial services to corporate and personal customers. It operates through the following business segments: Corporate Banking, Personal Banking, Treasury, and Others. The Corporate Banking segment provides a range of financial products and services to corporations, government agencies and financial institutions, which comprises of corporate loans, trade financing, deposit taking and wealth management services, agency services, financial consulting and advisory services, cash management services, remittance and settlement services, custody services, and guarantee services. The Personal Banking segment provides personal loans, deposit taking and wealth management services, card business, remittance services, and agency services to individual customers. The Treasury segment represents inter-bank money market transactions, repurchase and resale transactions, investments in debt securities, and trade of derivatives and foreign currency. The Others segment refers to equity investments and revenues, results, assets and liabilities of overseas branches and subsidiaries.

#3 – Hengan International (SEHK:1044): 7.29%

- Data as of 27 Oct 2021

- Based on share price of HK$40.90

- Dividend Yield: 7.29%

- PE Ratio: 8.88

- PB Ratio: 2.1

Hengan International Group Co., Ltd. engages in the trading of personal hygienic products. It operates through the following segments: Sanitary Napkins Products, Disposable Diapers Products, Tissue Paper Products, and Others. The company was founded in 1985 and is headquartered in Jinjiang, China.

#2 – ICBC (SEHK:1398): 7.34%

- Data as of 27 Oct 2021

- Based on share price of HK$4.32

- Dividend Yield: 7.34%

- PE Ratio: 4.21

- PB Ratio: 0.46

Industrial & Commercial Bank of China Ltd. engages in the provision of commercial banking and financial services. It operates through the following business segments: Corporate Banking, Personal Banking, Treasury Operations, and Others. The Corporate Banking segment provides corporate loans, trade financing, deposit-taking activities, corporate wealth management services, custody activities, and various types of corporate intermediary services to corporations, government agencies and financial institutions. The Personal Banking segment offers personal loans, deposit-taking activities, card business, personal wealth management services, and various types of personal intermediary services to individual customers. The Treasury Operations segment issues money market transactions, investment securities, foreign exchange transactions and the holding of derivative positions, for its own account or on behalf of customers. The Others segment includes assets, liabilities, income, and expenses that cannot be allocated to a segment.

#1 – Bank of China (SEHK:3988): 8.48%

- Data as of 27 Oct 2021

- Based on share price of HK$2.77

- Dividend Yield: 8.48%

- PE Ratio: 3.81

- PB Ratio: 0.34

Bank of China Ltd. engages in the provision of banking and financial services. It operates through the following business segments: Corporate Banking, Personal Banking, Treasury Operations, Investment Banking, Insurance, and Others. The Corporate Banking segment offers services to corporate customers, government authorities, and financial institutions such as current accounts, deposits, overdrafts, loans, custody, trade related products and other credit facilities, foreign currency, and derivative products. The Personal Banking segment provides services to retail customers such as current accounts, savings, deposits, investment savings products, credit and debit cards, consumer loans, and mortgages. The Treasury Operations segment deals in foreign exchange transactions, customer-based interest rate and foreign exchange derivative transactions, money market transactions, proprietary trading, and asset and liability management. The Investment Banking segment includes debt and equity underwriting and financial advisory, sales and trading of securities, stock brokerage, investment research and asset management services, and private equity investment services. The Insurance segment specializes in the underwriting of general and life insurance business and insurance agency services. The Others segment comprises of investment holding and miscellaneous activities.

P.S. like dividends? Join Chris Ng as he shares how he gets paid a regular dividend income by picking the right stocks.

can i check what is the witholding tax given that some of the dvd paid are in cny?

There’s no dividend tax if the company is domiciled in HK. If it is domiciled in Mainland China, the dividend tax would be 10%.

So just to confirm, the likes of bank of China is considered domiciled in Mainland China and CK Hutchinson is not?

yes. Depends on where they register the business entity