Editor’s Notes: Market cycles and market states determine asset performance and hence investment performance. Since the Early Retirement Masterclass is dynamic (takes place across different time periods), and since the markets are also dynamic (constantly in flux), the preset criteria each class must determine is to decide how to allocate their portfolios based on how the markets are currently trending.

This is not to say that our way is the best or the only way. It is simply our way and the way we have decided is optimal for us. Dyodd. Caveat Emptor.

It is very hard to determine which part of the market cycle we are in if we are just retail investors.

The simplest model of market cycles is that there are four possible states:

1) Expansion

When the expansion occurs, there is moderate growth of about 2-3% GDP. Inflation is on the low side and bank borrowings are trending upwards. At this stage, equities are the only asset class that does well.

2) Peak

After a period of grow, the market reaches its peak. This is characterised by GDP growth above 3%. strong credit growth and high inflation. At this stage, both commodities and equities do well.

3) Contraction

After the peak of the market, the contraction starts to occur. GDP growth begins to falter. Inflation drops slightly, manufacturing inventories starts to grow and credit tightens. At this stage, having bonds and equities are good for a portfolio.

4) Trough

A severe contraction can lead to negative GDP growth. Inventory and sales fall sharply and credit tightens even more. At this stage, the government will step in with stimulus. At this stage, only bonds do well.

The difficulty behind employing this model is that even with this definition of market cycles, it is difficult to pinpoint the exact phase of the market-cycle the retail investor is in. For each Early Retirement Masterclass, I will create a dashboard for my students that give them a snap-shot of the economy.

The snap-shot for the upcoming class is shown below:

Every snap-shot has positives and negatives that display contradictory results that cannot allow the economy to be neatly classified into a specific point within the market cycle.

For the positives, Q3 2019 GDP has turned around after a poor showing in Q2 2019. Manufacturing PMI has inched up slightly. If we rely on these economic figures, we would have arrived too late as investors as manufacturing stocks like UMS, Valuetronics and AEM has already moved ahead of these figures.

For the negatives, unemployment has inched upwards, business confidence continues to be poor and bank lending has dropped slightly.

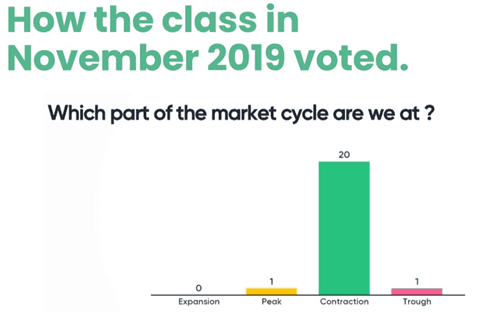

Generally speaking, the course does not attempt to tell students which part of the market cycle it is in. Instead, we let the class vote on it.

Last month, with a different set of readings the class, voted that the economy is still contraction mode.

This should have meant a higher allocation into bonds but note that a Singaporean audience would still not allocate their cash portion into bonds entirely because we have a significant amount in bonds already in the form of CPF.

The typical allocation for a class looks very much like what Batch 9 in November 2019 chose.

With some key numbers turning north and an impending resolution to the trade war between Trump and China, Batch 10 may have a more optimistic view as to where we are headed in 2020. The stock markets, in general, have cheap valuation as our STI ETF’s PE is less than 11 at the moment.

At this point, it is important to note that anything could happen within the days leading to the actual lesson.

For investors who want a serious discussion on market cycles and figure out how professional investors study market cycles, the best book to read is Ray Dalio’s Principles for Navigating Big Debt Crisis.

As a whole, we do not believe in predicting market cycles.

This exercise simply allows the class to set a frame of mind on where we are in the markets and the general direction we could be headed in. This is also balanced with a heavy dose of humility -> we never know where the markets could be a year from now and we don’t want to place our bets on exact circumstances taking place.

Instead, we look statistically at what has worked in the markets for the past 50 years and apply it to a local context favouring dividends (since dividends are not taxed as opposed to the US).

Going through this exercise also mentally prepares graduates of the Early Retirement Masterclass on where we could roughly be headed in the years ahead and provides a sort of mental readiness to be in the markets. This is important because peaks and troughs are a mandatory portions of any investor’s life and the unprepared investor will sell off his assets instead of buying more (as Chris did, which is probably the reason he’s a millionaire today).

Observe the sad part of such a transaction, the distressed investor would have panicked, been unable to stomach the losses, and sold off his stocks while Chris, bought more. The difference lies in the education (non-formal, degrees have nothing to do with this) and the temperament of the investor, which is why we seek to ensure our students do not repeat mistakes the rest of the market is likely to commit.

If you are keen to find out more about the Early Retirement Masterclass, you may do so here.

Did you enjoy the above article? Find out more about the most important performance driver for investment.

Good to see some focus on the mental aspects of investing.

I’m an optimistic feller, so I’ll say we’re in the early(!) stages of expansion & quite a way to go to even touch the peak. 😛

Of course I may be biased as I’m 90% invested! LOL!

Agree. I think the STI and SGX stocks are huge laggards and in general seem to have severely lagged the other global and Asian markets. My view only and DYODD.