Some notes before we begin:

My valuation strategy is mostly derived as our CNAV strategy. Case studies on its application can be found here, here, and here. We discuss this strategy and do a demonstration live here.

You can register for a seat here in order to fully understand how we derive the value of the companies correct down to the last cent, and at the same time, understand how we look at the stock market plus what we are going to be doing with regards to the downturn we see coming up ahead.

Value investing to me is about buying cheap. Sure, you can fundamentally identify “value” as growth as well, stating that a growth company is undervalued, but for the sake of those uninitiated, I think its better to avoid confusion and simply state that for the rest of this article – value investing refers to buying companies cheap.

On Dumpster Diving

Rule #1 – You can either have good prices or good news but you can’t have both

When companies are cheap, they’re cheap for good reasons. This should be common sense. Would you sell a top tier Patek Philippe watch for cheap? What about a Rolex? Would you buy it for cheap?

No. You wouldn’t.

The trouble with value investing in this sense is that few people are willing to buy companies that are cheap because in reality, when you look at companies that are cheap, there’s normally a whole long list of problems.

No shit, sherlock.

If companies that are cheap had no problems and looked good, they wouldn’t stay cheap for long.

The truth is that for an investor to outperform the markets, they must be able to truly see things as they are, not as what others around them perceive it to be.

Being in the markets is like being out in the public versus being at ease and at home.

Simply walking in public, going out of your house, maybe even your room imposes a certain sort of rigor on your body.

You might stand straighter, keep your hair neater, try to look less gormless. Your thoughts, actions, body language and behaviour are all subtly controlled by the very fact that you are in public, an ingrained response that has been taught to you since young.

As David Lyall Taylor puts it excellently here in his blog post,

Market sentiment is like water to fish. It’s the medium investors are currently swimming in, without recognising its existence. It’s the collection of assumptions and beliefs about reality and the outlook that form the prism through which people assess the prospects of companies and value them. Genuine contrarianism is not about valuing companies while looking at them through the same prism as other investors (in these situations, if you reach a different opinion you’ve probably missed something), but rather stepping further back to recognise what type of water investors are currently swimming in, and assessing the validity of those widely-held contextual assumptions, which are often mistaken as ‘truth’.

LT3000 Blog

The reality is this. Modern devices and mobile applications like facebook, twitter, instagram and blogs have now made it easy for thoughts and thinkings to pervade society. While this is good for spreading good thinking and good morals, its net negative when it comes to the enablement of critical thinking.

Few people thought Hyflux was a bad investment. At the height of being cash flow negative, people were oversubscribing to Hyflux perpetual bonds.

This loud echo chamber has allowed knowledge to often become a copy of a copy of a copy of a copy of a copy. Thinking has become rare. Imitation has become in vogue.

The ecosystem built by innovators who had hoped we would use it to massively propel ourselves forward in thought processes and the sharing of ideas has instead enabled us to regress backwards into laziness of thought.

This brings me to rule #2 when dumpster diving.

Rule #2 – Your true edge(alpha) in the markets, at any point in time, and at any place, is to call bullshit when facts and common thinking does not in fact, line up at all.

The importance of this should be immediately apparent if you consider the mental aspects of dumpster diving. Calling bullshit is needed and essential if you want to be able to find a stock that has been unfairly beaten down due to prevailing thoughts that are “trending”.

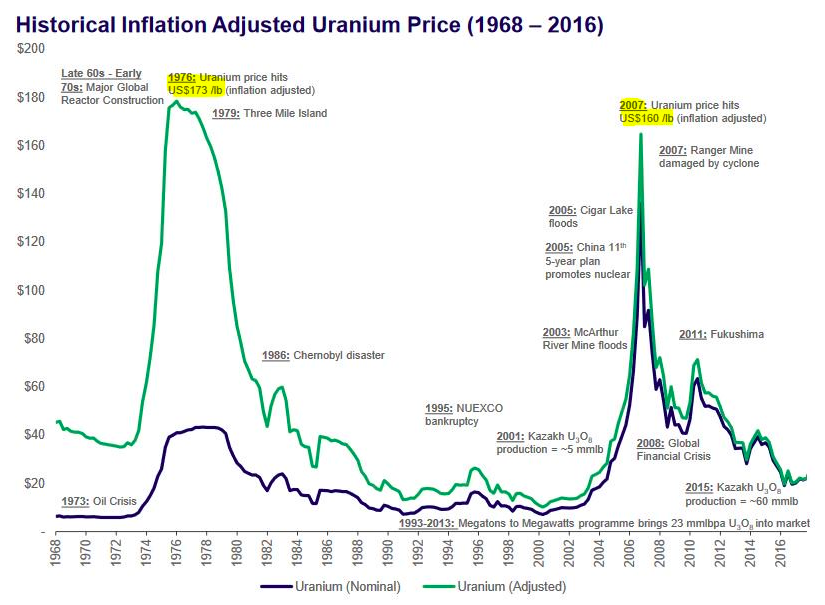

I’ll start with some examples. Right now, I’m looking into the oil/energy/uranium/shipping sectors for deep value stocks. Stocks selling so cheap, they’re better off dead.

What’s the prevailing thought about the various sectors?

- Oversupply

- Unprofitable due to the fact that oversupply has smashed prices.

- You don’t make money if it costs you $17,100 to run a ship and you can’t get people to rent it out for more than $17,100 [shipping]

- You don’t make money if it costs you $1 to drill a hole in the ground and you get $0.70 worth of oil coming back out.

- Debt burdens are increasing across the board for most companies as they can’t generate enough cash flow

In fact, shipping and oil/energy/uranium have been in decade long bear markets. I spoke previously about how cheap money enabled the US to escape the gravity pull of the financial crisis, that same cheap money enabled hundreds of competitors in a previously capital intensive space.

- Ships are not cheap to build.

- Oil wells are not cheap to drill.

- Uranium is not cheap to mine.

All of these sectors got whacked in the head with a baseball bat when the Federal Reserve decided, “You know what, let’s massively stimulate the economy and get out of this funk. we’ll think about the consequences later.”

What’s happened since then?

Waves of bankruptcies.

Oil/Shale.

I don’t have anything as nicely presented for shipping however, but do you really need me to show you one when one of the biggest players (with one of the most competitive edges therefore) went bankrupt in 2016 citing low freight rates and oversupply?

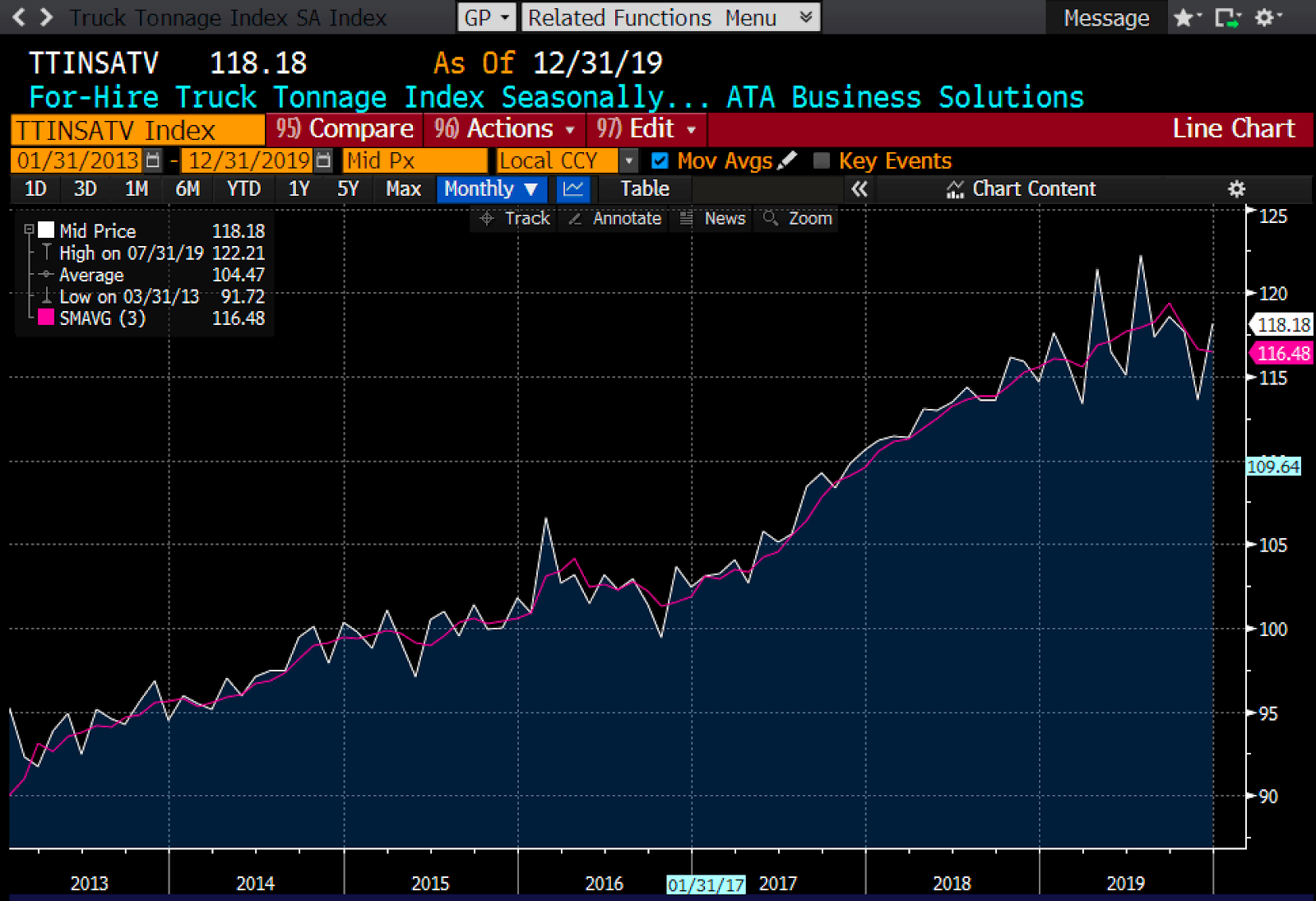

Hell, you’re starting to see effects in trucking companies too.

Then this happens.

What is the commonality between shipping, trucking, and oil?

- They’re capital intensive industries.

- They got murdered by ultra low interest rates that allowed competition to rapidly populate the market.

- Only the very best positioned companies will survive to pick up the pieces.

I love looking at industries such as this. When share prices head down unreasonably across the board, someone, somewhere will be worth taking a look at. I’ve done that with shipping (EURN, STNG, TNK). I’ve done that with uranium (URPTF). I’ve done that with energy (SD, AR, GTE, Tethys, TUSK, TAT, WTI, VAL, UNG, HNRG). And I’ve just started looking at trucking.

*I've invested in some and may invest in all of the names. I have positions in all shipping names mentioned. Do your own due diligence.

Why? Because I believe this is where you get to find companies which are trading under total asset value – total liabilities, with strong upside potential once the competition dies off. You get to own assets cheap and the business free.

So does this all work? Why does investing in cheap companies work to begin with? Yeah sure, we have definitive evidence it works. Proof. Studies. But why? Why is this effect so persistent and strong despite all of us knowing about it? Why don’t more people crowd in to buy it? Beyond simple psychological difficulties, the effect is simple mean reversion.

Understanding Mean Reversion

The “0” line is the line to which profits mean revert. How is this crucial to the understanding of buying undervalued companies?

- If there are huge profit margins, competition will soon enter the arena and fight for market share and a slice of the profits. Supply goes up. Prices come down.

- If there are huge losses, competition dies, get acquired, merges, or exits the marketspace through bankruptcy or just plain shuttering its doors. Survivors get to pick up the pieces.

The problem with mean reversion is “lag“. Or “economic lag” rather. This stems from a series of human reactions that lag real time economic data.

- The word is a vast and complicated space where information is not exactly easy to come by and analyse.

- How many trucks got on the road? What are average rates now for truck hire?

- How much will rates drop if 10,000 more trucks hit the road? 10%? 20%? 30%? 50%?

- This lag of information only becomes apparent over time after oversupply has already been reached and it is already too late. Imagine now you’re the CEO of a newly minted shipping company with $100 million worth of ships. 6 months in, you realise there’s an oversupply. What do you do? Close up shop and go home? No. You don’t. You hold. You try to wait it out. You try to fight for tomorrow so that you have a better chance. Maybe you get smart and lock in barely profitable rates before rates drop further. Maybe you buy fuel for your trucks and ships cheaper than your competitors. Maybe you merge with a oil company to lower cost. Maybe you dilute your shareholders a little bit. But you don’t quit.

- This “not quitting” part leads to a classic cage battle to the death match. Companies compete to see who can come out on top like a battle royale and only the winners get to keep the trophy. Everyone else gets bought out, folds to bankruptcy or merges to fight another day. Some get liquidated.

- Eventually, this supply destructive effect lags, just as the over-supply effect lagged at the start. This is when you see demand suddenly go, “hey, I need to move oil from Saudi Arabia to China. Where are all the damned ships? Why is it moving up? What the hell? I better lock in rates now for the future!“

- And then the race to the top begins, with oil majors and exports/and import/export companies all rushing to get rates locked in (which mean higher rates and premiums).

- This further overemphasizes a lack of supply and rates then shoot through the roof leading once again to profitability, once again because of lag.

- And the cycle repeats itself.

In the process, when you’re positioned at the bottom of the cycle (with a proper valuation process that lets you differentiate the winning companies from the dead ones), you get to ride the trend up.

Just look at Uranium.

The time lag is real in cyclical industries for a good reason.

This confers a so-called “timing” effect. It pays to “time” your entry well here since you don’t want to be buying into a dead company on the way down but you do want to buy a company that’s cheap and then goes up.

Who doesn’t right?

Rather than tell you timing doesn’t specifically work or that timing is absolutely required, I wish instead to tell you, that as with all things, there is a balance to the “timing” factor.

And in order to understand “value” and “timing”, we have to look at the market cycle.

Market Cycle & Timing

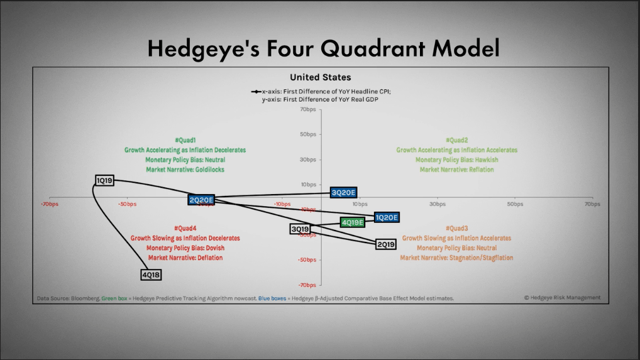

I believe that it is possible broadly speaking, and only absolutely at a broad level, to have a general idea of where we are in the market cycle.

I will not go too far into details here, I will instead say, that broadly, the economy is slowing down and that broadly, we’re overdue for a recession though that is yet to come. We are in the last phase of the bull run, it feels like and we still need to be cautious because the drop can be painful and steep given how long this bull market has gone on (12 years).

Above, I spoke to using Valuation of a company as timing. Valuation confers how deeply undervalued a company is relative to assets, and that valuation allows investors to get in with a margin of safety. That margin of safety allows investors to “pick the stock at the bottom” as it were.

Most margins of safety will not exist, and a company will not be undervalued as it is, if its share price was not low enough. Timing, therefore, is mostly a matter of value. The right time to buy a company is when it is undervalued enough. Not before.

Can we improve our timing?

Thus, your process of determining if a company is undervalued enough is important. In addition, I spoke here about using insider buying as a “signal” that a company’s fortunes are about to reverse.

- Look for clustered insider buying.

- Separate buying from routine annual purchases.

- Look for buying that is large in relative terms to salary of insiders.

You can read the full piece here.

So which companies am I looking at?

*ticker symbols only.

*disclaimer: you are responsible for your own purchases. companies mentioned are being looked at, not yet, vested. If vest, I will indicate accordingly.

Sector Wise:

- Shipping

- vested in Scorpio Tankers, Teekay Tankers, Euronav [supply demand imbalance, cheap]

- looking at DSSI, DHT [same as above]

- Oil/Energy/Coal [mix of ESG nonsense against coal, coronavirus fears, oversupply of shale and oil]

- ECA Marcellus Trust 1 [cheap, earns royalties on gas produced, if gas prices go up because of shale industry collapse, earnings explode upwards]

- Peabody Energy Corporation [cheap, buying back shares]

- Sandridge Energy [cheap, activist]

- Antero Resources [cheap, share buybacks]

- TransAtlantic Petroleum Ltd. [insider buying]

- W&T Offshore, Inc. [insider buying]

- Mammoth Energy Services, Inc. [insider buying]

- Valaris PLC [cheap, offshore, shale collapses offshore increases in value play]

- Hallador Energy Company [cheap, company growing in a shrinking industry]

- Contango Oil & Gas Company [insider buying]

- Warrior Met Coal [metallurgical coal, ESG price suppression]

- Trucking [oversupply, wave of bankruptcies hit, waiting to see if rates can tick up and if they’re cheap]

- USA Truck, Inc. [insider buying]

- U.S. Xpress Enterprises, Inc. [insider buying]

- Uranium [classic undersupply vs growing demand problem]

- Uranium Participation Corp [cheap relative to current Uranium spot prices, which in itself is cheap compared against needed production levle prices]

- Gold [anti-inflation play, also very cheap, but complicated]

- Dundee Corporation [dirt cheap, owns multiple companies, 20% ownership of Dundee precious metals equals entire Dundee Corp market cap, you get everything else free]

- Counter-Cyclical

- Altisource Portfolio Solutions

- Aspen Group

- Universal Technical Institute

My Criteria

A rough guide of how I’m going about looking at this companies.

- Company is either buying shares back or have activist investors at the helm as is the case with Carl Icahn and Sandridge Energy

- Company insiders show clustered insider buying

- Company must be deeply undervalued and able to fulfill all debt obligations over next 3-5 years

- Supply/demand imbalance leading to a “when” not “if” scenario

- Companies must be able to have some advantage as compared to broad markets. My shipping companies have the best fleet. My energy picks have good balance sheets or low cost of productions or hedged their production prices. My uranium pick is mostly a big uranium holding co. Or they’re just…dirt cheap.

- My exit strategy

- Sell when fundamentals deteriorate or if companies don’t look to be meeting debt obligations

- Sell after three years if nothing happens

- If valuation rockets up past NAV, sell when fundamentals/momentum breaks. I’ve seen cyclical companies go on to become 10 baggers, 20 baggers, 30 baggers. Frontline was a 50 bagger in the last shipping bull market with dividends included inside of a space of three years. No point letting profits slide off the table when you can hold onto the rocket ship up.

Broadly speaking, I want them cheap, with a clear sector trend at their back helping them, with insiders buying in clusters and with healthy balance sheets.

A note, not all the companies above pass my criteria. Most of them are in a watchlist. Some of them I’m waiting for cash to buy more of. Do your own due diligence.

Another note, when we’re doing deep value, buy a basket of good companies. Don’t concentrate too heavily in one or two companies. Aim to own at least 4-5 of them that are good. You never know when shit hits the fan just like the Coronavirus fears hit my shipping stocks.

We discuss this strategy and do a demonstration live here.

You can register for a seat here in order to fully understand how we derive the value of the companies correct down to the last cent, and at the same time, understand how we look at the stock market plus what we are going to be doing with regards to the downturn we see coming up ahead.