Editor’s Notes: Temasek Holdings, Singapore’s state-owned investment firm has offered a $4 billion partial offer for Keppel. TheBearProwl believes based on fundamental valuations, in the long term, this is a poor price. Good for the state, bad for current Keppel investors. This is Keppel’s current statistics.

Background

Keppel is currently a multi-business company providing robust solutions for sustainable urbanisation that meet the world’s needs for energy, clean environments, quality real estate, connectivity and more.

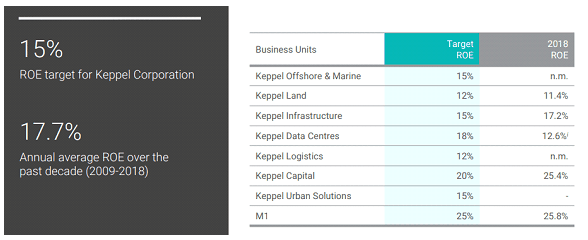

Keppel first indicated that it’s mid to long term ROE target of 15% during its 1Q19 result briefing and also provided guidance on the target for each business unit.

We will analyse whether this target is attainable in the sections below.

Keppel has 4 business units, which it refers to as engines below.

The business model presented below is not unique and aims to supplement project-based income with recurring income. ROE is further driven by asset valuation gains and recycling of capital. Recycling of capital also allows Keppel to reposition into investments with a potential for higher returns.

Keppel currently organises into 4 business units based on its products and services:

(i) Offshore & Marine

Principal activities include offshore rig design, construction, repair and upgrading, ship conversions and repair, and specialised shipbuilding. The Division has operations in Brazil, China, Singapore, the United States and other countries.

(ii) Property

Principal activities include property development and investment, and property fund management. The Division has operations in Australia, China, India, Indonesia, Singapore, Vietnam and other countries.

(iii) Infrastructure

Principal activities include environmental engineering, power generation, logistics and data centres. The Division has operations in China, Qatar, Singapore, United Kingdom and other countries.

(iv) Investments

The Investments Division consists mainly of the Group’s investments in fund management, KrisEnergy Limited, M1 Limited, k1 Ventures Ltd, Sino-Singapore Tianjin Eco-City Investment and Development Co., Limited and equities.

Some products which Keppel presents as solutions are detailed in the snapshot below.

Financials

- YTD 3Q19, Keppel recorded revenues of $5.4b and net profit of $0.5b.

- The net profit translates into earnings per share(eps) of 28.4cents. On an annualised basis, we are looking at net profits of $0.7b and eps of 37.9cents.

- An interim dividend of 8 cents was declared which was 2 cents less than FY18 but in line with FY17 & FY16.

- While Keppel does not have a formal dividend policy, the Company has a consistent track record of distributing about 40-50% of its annual net profits.

- Keppel has an equity base of $11.1b with net debt of $9.4b, translating into a NAV of $6.12 and a gearing ratio of 0.82x.

- Keppel recorded a net profit of $933m in FY18 which translates into 8.3% ROE.

- On an annualised basis, Keppel is looking to generate an ROE of 6.1% in FY19.

This underperformance mainly arises from the property segment and is due to the lack of divestment gains in FY19. The equity base of Keppel in FY18 is $11.6b which means a 15% ROE target requires $1.7b in net profit

Investment thesis

We will perform a segmental analysis of the 4 core segments to assess the reasonableness of management’s blended 15% ROE target.

We will perform a light-touch review of each segment by our views rather than provide background information as such information is readily available should you wish to perform your own due diligence on this company.

In summary, we think the business challenge to deliver a consistent ROE will come from the O&M division, however, we believe the other property and infrastructure segments can make up for any shortfall.

Also, while we think achieving a consistent 15% ROE target is great, we view this as shooting for the skies. If Keppel falls short and lands on a consistent ROE of between 11-13%, we think this will still be a good investment for the long haul.

Segment #1 – Offshore & Marine

We previously wrote a short position on Sembcorp Marine(SMM) and most of the comments there would apply to Keppel’s O&M(KOM) segment. Similar to SMM, KOM has been focused on innovation to position themselves for the next upswing in the industry.

We think the key difference between KOM & SMM is the M1 investment which provides KOM with the ability to leverage on technologies such as Artificial Intelligence (AI) and Industrial Internet of Things (IIOT).

KOM is also partnering M1 to leverage the telco’s ultra-low latency 4.5G network connectivity to establish standards and data transfer links for the ship-to-shore communication, and support mission-critical Internet of Things maritime applications.

Key Risks to Target – Offshore & Marine

As mentioned above, the ability for this segment to deliver consistent ROE is questionable due to its recent track record. Over the years as Keppel grew, KOM has become a smaller proportion of the Group, accounting for only 25% of the equity base. Without going into the detailed calculations, we think a sustainable long-term ROE target is about 8%, which means there is a shortfall of 7% ROE or $200m.

Segment #2 – Property

Keppel Land provides innovative real estate solutions and has a sterling portfolio of award-winning residential developments, investment-grade commercial properties and integrated townships. Keppel Land is geographically diversified in Asia, with Singapore, China and Vietnam as its key markets, and it continues to scale up in other markets such as Indonesia and India. It is also developing the Sino-Singapore Tianjin Eco-City (SSTEC) and Saigon Sports City (SSC).

Key Risks to Target – Property

The ROE this segment has achieved in the past 5 years is between 8 to 11% and is dependent on unlocking value both from its development pipeline and by recycling capital on its fully commercialised properties. We think a realistic long-term ROE target is about 10%, implying a 2% ROE shortfall or $160m.

Segment #3 – Infrastructure

This segment is able to not only develop, own and operate energy and infrastructure assets, but also provide a wide spectrum of technology solutions, and also other services. The segment also has a pipeline of projects under development including the Keppel Marina East Desalination Plant as well as Hong Kong’s first integrated waste management facility.

Key Risks to Target – Infrastructure

The key to success for this segment is innovation and advancement in the suite of solutions that they can offer. We do not see a risk to target in this segment as it has been performing well consistently.

Segment #4 – Investments

This is the segment with the highest potential. It will likely continue to grow its Assets Under Management (AUM) and also its investments like M1. The underperformance in recent years was due to the investment in KrisEnergy and also in unquoted equity securities. We expect to see growth in management fee income, return on investments and also synergies in the future years.

Key Risks to Target – Investments

M1 is accounts for more than half of this segment. M1 was taken private by Keppel so as to restructure and position M1 to maintain its competitive positioning in Singapore for the long term as there was a multitude of issues facing M1 and the industry it operates in.

The key is to integrate M1’s solutions into the Keppel suite of capabilities and drive value. While we believe this segment is able to hit its ROE target, we think it is too early to fully grasp M1’s impact into the Keppel Group.

Valuation and Price Target with a lower Return On Equity

Based on the above, the combined ROE is about 13%. Nevertheless, we looked at a 7-year timeframe where we assumed an average of 9% ROE in the first 5 years and 15% ROE in the subsequent 2 years, and a 40% payout ratio (i.e. 60% reinvestment of capital).

We obtained a NAV of $9.66 and a dividend paid of $2.46 at the end of the 7-year time frame. The earnings per share at the end of the 7-year time frame is $1.45. Based on the current share price of $5.9, the current year projected PE ratio is 15 and P/B ratio is 0.95.

We think a reasonable price range for Keppel for Project 2025 is $12 to $15 based on the following data; the historical range for PE is 5 to 25 with an average of 13, and P/B is 0.8 to 2.8. Based on a 40% payout ratio on an eps of $1.45 and a dividend yield of 4-5%, we are able to also support the projected share price.

Upside based on current share price (inclusive of dividends): 210% to 300%

Project 2025’s intrinsic value: S$15

Would you account for any potential recession risk, exposure or short term downsides in this purchase price?

Yes – we used an average of 9% ROE in our valuation for the first 5 years

Yes – we used an average of 9% ROE in our valuation for the first 5 years

I find it hard to believe that you can arrive at an intrinsic value of $15 when Keppel has never even hit that price before.

If the current ROE is already so terrible, how can you be so optimistic about management projections? 15% ROE? What kind of world are you living in?

Your assertion is that investments has the highest potential. Yet you fail to substantiate how these investments are doing and how they are likely to turn out. Your ROE forecasts for these are arbitary and high.

Viewed in totality, I don’t think you have done enough homework on the company.

1. The management’s projection is for a medium term steady state return. We took a swing and landed at lower, which was between 11-13%.

Despite that, we modeled our intrinsic value based on a lower growth to NAV (9% roe for 5 years and 15% roe for 2 years)and obtained a value we were comfortable with.

The historical P/B & PE served as an additional reference point and we note that our target price sits in the middle of this range.

To achieve all this, the Group also has to be able to not only generate recurring income consistently, but also allocate and recycle capital well.

2. The investment segment recorded -$54m in losses, and currently has a $377m gap to target. -$80m was due to KrisEnergy’s operating results, – $53m from impairment in KrisEnergy and -$47m due to ‘one-off.

KrisEnergy should be fully written off or turnaround in a steady state scenario. This explains $180m of the gap. Growth from the remaining business units like SSTEC is expect to continue.

2a. M1 contributed $22m to Keppel’s bottomline with Keppel’s 80% stake. Keppel is targeting at least $86m profit on M1. This explains minimally $64m of the gap and does not account for further investments into M1 in subsequent years.

2b. Keppel aims to grow its AUM by an additional $21b in the next 4 this translates to at least $100m in profits. This will be driven from both property and O&M assets and also from investment by funds into Keppel Capital.

2c. Urban solution – Keppel intends to invest significant levels of capital to develop this segment and we expect a decent ROE as well.

3. Please note that while you may find it hard to believe that Keppel can hit $15 as it has never hit the price before, you are also actually looking at a company that has the ability to grow.

We do not go into significant level of details in our write up as we try to balance between a lengthy article and a palatable one for most readers.

Please take comfort in our assurance that our analyst loves to go into the details. Therefore, do feel free to drop us a note if you would like to show us why our ROE is high and we can compare notes.

Hi

After going through the O&M of Keppel,it is not mentioned about order cancellations recently.