I have been following and reading Tobias Carlisle’s books all these while – from Deep Value, Quantitative Value to Concentrated Investing. Each book has been enlightening and I gain new insights to investing after every read.Recently, Tobias wrote and published a new book titled, The Acquirer’s Multiple.

The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market

I was puzzled when I first heard of this brand new book.

“Hmm, I thought he has talked about this concept in his earlier books. Why this again? Is this just another re-hashed product? Is he running out of new content?”Since I had picked up very valuable tidbits from all his previous book, I decided to give it a chance and not judge the book by its title.

After reading the Preface, I realised this book was targeted at the beginners and is a simplified version of his previous books. It was a great refresher to the Tobias Carlisle’s Acquirer’s Multiple.

As I read it, 5 unconventional but practical value investing ideas stood out. I’ve extracted them out for you here:

#1. Pick ‘Cheap’ Stocks

Warren Buffett has a famous phrase,

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Tobais challenges Warren Buffett’s advice in his book.

He explained and proved, using various studies backed with real data, that buying fair companies at wonderful prices provided higher returns than buying wonderful companies.

The best example for me was the study on the quality of companies, as discussed in Tom Peters’s 1982 bestseller, In Search of Excellence.

Peters dissected principles that made 43 companies “excellent”.

Following his study, Barry Bannister reviewed the performance of these “excellent” stocks versus the “un-excellent” stocks in 2013. The results were rather surprising:

Stocks that were labelled as “Unexcellent” significantly outperformed those that were labelled as “Excellent”.

Tobias goes on to share that Warren Buffett had been successful investing in such fair companies during his earlier years. This was a skill he picked up while he was working with Benjamin Graham.

Buffett called this the “cigar-butt strategy“. He bought stocks like Dempster Mills and Sanborn Maps.

It was only later when his capital became larger, that he had to move on to invest in larger companies.

#2. What Goes Up Must Come Down

Tobias attributed the performance of cheap stocks to “mean reversion”.

In simple terms, “mean reversion” just means that what goes up should come down and vice versa.

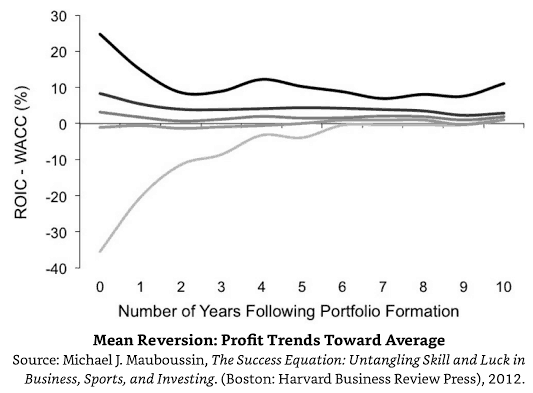

He quoted the study by Michael Mauboussin which was published in the book, The Success Equation: Untangling Skill and Luck in Business, Sports, and Investing:

Mauboussin showed how unusually high or low profits trend toward the average by tracking one thousand companies from 2000 to 2010.

He ranked the businesses on economic profit – how wonderful each was – in the year 2000. And put them into five groups. The top group was the most profitable. These were the great businesses. He put the bad businesses in the bottom group. These, on average, lose money.The chart below shows the results. For each of the five groups, there is a clear trend toward average profits. The highly profitable companies become less profitable. The loss makers lose less money. All trend toward average profitability:

#3. Less Metrics = Higher Returns

Joel Greenblatt is a famous hedge fund manager in the investing circle. He wrote The Little Book That Beats The Market detailing the Magic Formula investing strategy.

The strategy relies only on two metrics; Return On Capital and Earnings Yield to determine which stocks to buy. An investor could rely solely on these numbers alone and achieve 30.8% per year in the period of 1988 to 2004! (as reported in the book)

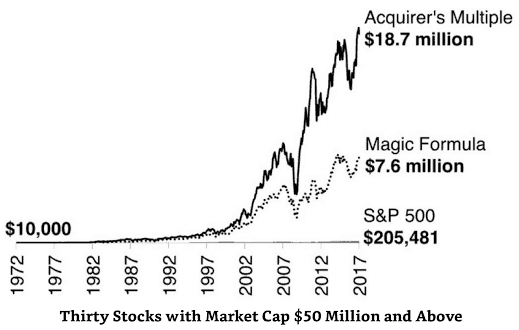

Tobias Carlisle tested the metrics separately and realised that the Earnings Yield was performing better than the combined metrics!

That finding essentially gave rise to his establishment of the Acquirer’s Multiple.

It is now one of the best single metrics to use to invest in deeply undervalued stocks:

#4. Undervalued Stocks That Do NOT Pay Dividends, Tend To Perform Better

Henry Oppenheimer, an associate professor of finance at the State University of New York, published a thought-provoking finding in 1983:

For each stock, Oppenheimer worked out the discount to its cigar-butt value.

He put the stocks into five groups, from the most undervalued to the most expensive. The most undervalued group beat the next group and so on. The most expensive group had the lowest returns. The most undervalued group beat the most expensive group by more than 10 percent a year.

Oppenheimer’s second finding is his most interesting one. He split the stocks into two groups. One had only profitable stocks, and the other, only loss makers. Oppenheimer found the loss makers beat the profitable group.

His third finding is also interesting. He split the profitable group again. The first group was comprised of dividend-paying stocks. The second group paid no dividend.

Oppenheimer found the stocks that didn’t pay a dividend beat the ones that did.

It seems like the ‘ugliest’ stocks tend to deliver better returns in the future!

#5. Follow Investing Rules

We humans tend to think investment decisions are best left to human judgment. There are enough people who believe that investing could never be reduced to a set of rules.

Counter-intuitively, Joel Greenblatt found that those who followed the Magic Formula closely did better than those who cherry pick from the stock list.

Joel Greenblatt has found that investors struggle to implement his Magic Formula in practice.

In a great piece published in 2012, “Adding Your Two Cents May Cost You A Lot Over The Long Term,” Greenblatt examined the first two years of returns to his firm’s US separately managed accounts.

Greenblatt conducted a great real-time behavioral investing experiment. He gave his clients two choices to invest in US stocks.

- One account was like the business owner. They picked what top-ranked stocks to buy or sell and when to make these trades.

- The other was like the quant investor. This account followed a systematic process that bought and sold top-ranked stocks automatically.

Essentially, business-owner accounts had discretion over buy and sell decisions, while quant-investor accounts were automated. Both choose from the same list of stocks.

So, what happened?

The business-owner accounts didn’t do badly. Those accounts averaged 59.4% after all expenses over the two years, a good return. But the S&P 500 rose 62.7% over the same two years.

The quant investors account averaged 84.1% after all expenses over the same two years, beating the business owner by almost 24% (and the S&P 500 by well over 20%).

That’s a huge difference, particularly since both accounts chose stocks from the same list and were supposed to follow the same plan.

Conclusion

If you are keen to learn about quantitative investing or deep value investing, this is a good starter book for you.

This can be complete in a couple of hours but yet, it contains rich and practical knowledge for investors.

Numerous reputable studies about the stock market have been summarised, and their lessons distilled in this easy-to-read book.

I might be biased because I prefer a number-based investing method. I hope after you read The Acquirer’s Multiple by Tobias Carlisle, you will be convinced as well.

Hey man, I saw your interview of him on YouTube. I’m thinking of taking the plunge but have a couple of doubts. The first is that he could have used a backtest which supports his idea. Independent backtesting is needed and I have found one – Quantopian did it and seemed to find the same level of returns. The second issue is that he hasn’t told me how a portfolio bought based on AM screening has done since the idea was first floated in 2015. I would feel more comfortable getting involved if a chart of performance, compared to the SPX and a growth portfolio (FAANGs for example) was provided. He does do this in a blog post, saying it’s underperforming the market by 20%. Thoughts?

Value has underperformed in the last few years and historically it has been so in certain periods. Each underperforming period can run for years so you need do need a lot of patience and conviction to ride them through. Even for Asia, small cap value didn’t do so well in 2017-18.

Hi Alvin, nice summary on AM!

What’s still not clear to me is how should annually rebalance our AM portfolio, bcoz the presentation is a bit vague in the book. Here’s what I came up with: (cmiiw)

Annual Rebalance Rules:

#1 – Profits YES, Screener ON

–> then HOLD until Screener OFF (when exactly? Another year? Next quarter? Immediately?)

#2 – Profits YES, Screener OFF

–> then SELL

#3 – Profits NO, Screener ON

–> then HOLD until Screener OFF (when exactly? Another year? Next quarter? Immediately?)

#4 – Profits NO, Screener OFF

–> then SELL

Actually I”m also confused about how to rebalance an NCAV net-nets portfolio, but that’s a different story…