As retail sales in Singapore continue to rise, with analysts forecasting double digit percentage growth for the year 2023, we look at these 4 retail REIT’s performance with a focus on their retail assets in their latest earnings release to see how they fared operationally.

p.s. If you’re curious about how the data center REITs performed, here’s the Singapore DC REIT earnings round up

1) Frasers Centrepoint Trust (SGX:J69U)

FCT delivered a resilient performance for its FY22 which ended on 30 Sept 22. FY22 revenue increased 4.6% and DPU increased 1.2%.

In FCT’s recent 1Q23 business update, the REIT recorded further improvement to its operational performance. The committed occupancy in its retail portfolio improved 0.9% QoQ and 1.2% YoY to 98.4% while shopper traffic increased 38.3% YoY and tenants’ sales increased 13.4% YoY.

Despite shopper traffic in 2022 averaging around 80% of pre COVID level. Tenants’ sales is 12% above pre COVID levels. FCT believes this reflects the trend of mall visitations becoming more purposeful.

FCT is also taking the opportunity to carry out asset enhancement initiatives (AEI) at its Tampines 1 mall. It expects to spend $38 million to rejuvenate and enhance the mall. The AEI will commence in 2Q23 and will add 8,000 sqft in net leasable area after the AEI is completed in 3Q24. FCT has already obtained 70% of pre-commitment for the AEI spaces prior to works commencement from tenants such as Love Bonito, Tiong Bahru Bakery, Collins and Sushi Plus.

FCT also just jointly announced the acquisition of NEX, the suburban retail mall located in Serangoon with Frasers Property. The combined Frasers group will acquire 50% of NEX and FCT will hold a 25.5% share in NEX after the acquisition. The acquisition will be funded by debt and FCT will see a DPU accretion of a mere 0.52%.

2) Starhill Global REIT (SGX:P40U)

Starhill’s gross revenue for 1H23 (Starhill’s financial year end is June 2023) was up 4.1% YoY at S$94.7 million from S$91 million. The DPU was up 2.2% at 1.82 cent, compared with 1.78 cent a year ago.

The DPU increase is lower as Starhill retained about 6% of income available for distribution for its working capital requirements. Note that a REIT is required to distribute at least 90% of profits to qualify for tax transparency treatment.

Starhill attributed the better performance to the completion of asset enhancement works at The Starhill (retail mall in Kuala Lumpur, Malaysia), lower rental assistance and higher rental contribution from Singapore Office, partially offset by lower rental contribution from Wisma Atria (Property) Retail.

Tenant sales and shopper traffic at the Wisma Atria Property in improved y-o-y by 32.6% and 30.0% respectively, in spite of ongoing interior enhancement works which is expected to be completed in February 2023.

3) Mapletree Pan Asia Commercial Trust (SGX:N2IU)

In the first full quarter since the merger between Mapletree Commercial Trust and Mapletree North Asia Commercial Trust took effect on 21 July 22, MPACT delivered DPU of 2.42 cents for 3Q FY22/23, in line with 3Q FY21/22.

Noting that DPU for 1H FY22/23 was 4.94 cents, 12.5% higher than 1H FY21/22, this would mean that MPACT’s DPU declined sequentially in 3Q FY22/23.

A DPU decline in spite of aggregate leverage ratio increasing from 34.1% in Dec 2021 before the merger to 40.2% in Dec 2022 may indicate that the merger was likely not as accretive as it was projected to be. This is attributable to market conditions since the announcement of the merger.

The underwhelming performance was attributed to the protracted COVID restrictions in China and Hong Kong as footfall and tenant sales at Festival Walk continued to be impacted by the effects of COVID measures.

MPACT’s core MCT portfolio outperformed as positive rental uplifts were recorded across all markets outside of Greater China with VivoCity registering 7.9% rental uplift year to date. On the other hand, Festival Walk registered negative rental reversion of -12.7%.

VivoCity recorded strong spending as tenant sales surpassed pre-covid levels despite footfall at 72% of pre-covid levels, attesting to the improvement of VivoCity’s offering since before the pandemic.

VivoCity has a track record for asset enhancement initiatives(AEI) that value add to existing space. The current AEI for the space previously utilised by the TANGS department store will add 18,000 sqft of space and expect to deliver estimated ROI of more than 10% based on a capex of $13 million.

Festival Walk’s footfall and tenant sales were at 69% and 73% of FY18/19 levels (pre-social incident and pre-covid levels).

Tenant sales for Festival Walk for YTD FY22/23 were also slightly lower than YTD FY21/22, reflecting further structural deterioration.

Occupancy for VivoCity and Festival Walk remained high at 98.3% and 99.8% respectively, with WALE at 2.1 years for the retail assets combined.

With the negative rental reversion in Festival Walk in the current financial year and the reopening expected to boost recovery, the low WALE could be viewed as an opportunity to achieve positive rental reversion quickly and will be one to look out for.

4) CapitaLand Integrated Commercial Trust (SGX:C38U)

CICT reported DPU for 2H22 of 5.36 cents up 2.7% YoY and a full year total DPU of 10.58 cents, up 1.7% YoY. This was achieved by acquisitions, higher gross rental income and gross turnover, partially offset by higher operating expenses from its acquisitions and utilities.

The better performance was due to higher committed occupancy, positive rent reversion trend for both its retail and office portfolios as its retail tenants’ sales also surpassed 2019 levels, similar to MPACT’s VivoCity.

The overall shopper traffic was also on a rising trend as downtown malls saw higher rebound with border relaxation and with the return of office community.

CICT’s retail portfolio saw tenant sales for FY22 increase by 11.5% in its suburban malls while downtown malls recorded a 38.1% increase as shopper traffic increased by 20% and 31% respectively.

CICT recorded a portfolio rental reversion of 1.2%, mainly due to suburban malls recording 2.3% rental reversion while downtown malls recorded 0.2%.

The retail portfolio’s valuation increased 1% to $7.2 billion as 9 out of 10 Singapore retail malls recorded revaluation gains with the valuation of 1 mall remaining steady.

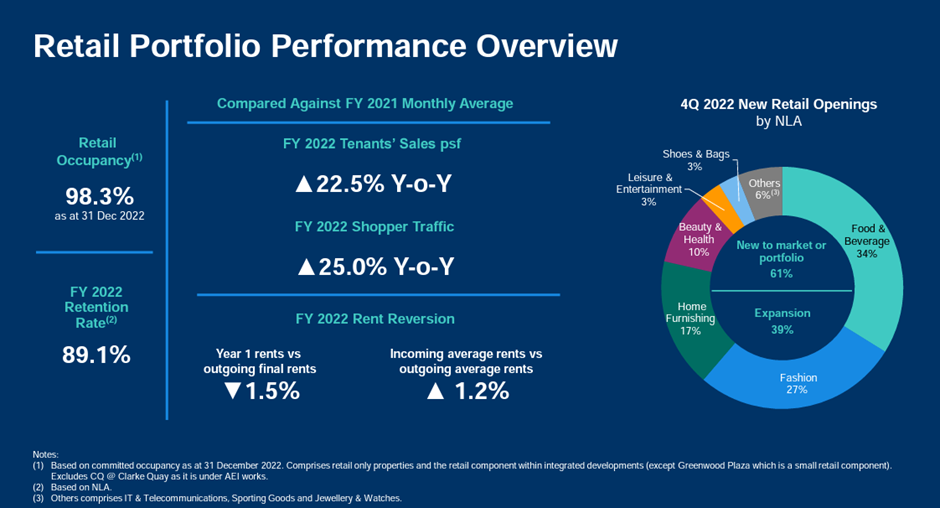

CICT’s committed occupancy for its retail properties was at 98.3% and its tenant retention rate was 89.1%. The WALE stood at 2.2 years.

Closing statements

Overall, the 4 REITs have done well as Singapore moves towards normality, but challenging macro conditions could affect the performance in 2023.

Upside growth factors could still come from the continued recovery in leisure and business air travel and inbound tourism, which will benefit many in-person service sectors, and the impact of China’s reopening from Jan 8, 2023, is likely to be positive for Singapore’s travel- and tourism-related sectors including retail, but the boost from China’s reopening is highly uncertain as there are various factors that may limit the return of inbound Chinese tourists, especially in the near term.

On the other hand, Singapore’s Prime Minister Lee Hsien Loong has warned Singaporeans to brace for uncertainties ahead as the troubled international outlook would affect the economy.

CBRE noted that Islandwide retail rents increased for the second consecutive quarter as Suburban prime rents went up 1% QoQ and 2.3% YoY while Orchard Road prime rents went up 0.3% QoQ and 1.0% YoY. CBRE also expects overall rent to continue recovering in 2023.

However, 2023’s retail supply of 0.9 million sqft is forecasted to be slightly higher than the 5 year average of 0.6 million sqft due to project completion delays from 2022. This may be a short term overhang to rent prices.

Thinking of scooping up some S-REITs? Chris Ng will be sharing his experience and insights as an active dividend investor live -> Join him.

Good assessments of abive reits