Blue chips were down.

REITs were down.

U.S. stocks were down.

Even Bonds, Gold and Bitcoin joined in the fun going southwards.

Everything seems to be out-of-whack and investors just wanted cash and nothing else, liquidating whatever investments they had.

I was wondering if there was anyone who had made money during such times?

My guess was that short term traders would have the best chance since higher volatility means they have more room for prices to gyrate and hence higher profit margins.

I asked Robin about his trades for the past 2 weeks and he dumped me with his list of settled trades.

It was long. The amount of trades he did for the last 1 month was what I would do in years!

Nonetheless, I tabulated his results in a spreadsheet and I was impressed. It was a mixture of stocks and indices traded through Contracts For Difference (CFDs). A whopping S$175,925 gain while most investors are reeling from paper/realised losses. Mind you, I didn’t count his Daily Leverage Certificates (DLC) and Warrants trades in this table, which would add on to the profits.

Let’s dissect some trades he has done.

Norwegian Cruise Line (NYSE:NCLH)

One of his biggest wins was Norwegian Cruise. It wasn’t surprising that the cruises were not doing well during the Coronavirus but who would have expect the prices to drop by over 70%!

He built up multiple short position of a total of 1,100 shares in Norwegian Cruise Line over a span of a month. See the trades done in the demarcated stock chart below (click to enlarge):

The total profit was S$16,255.

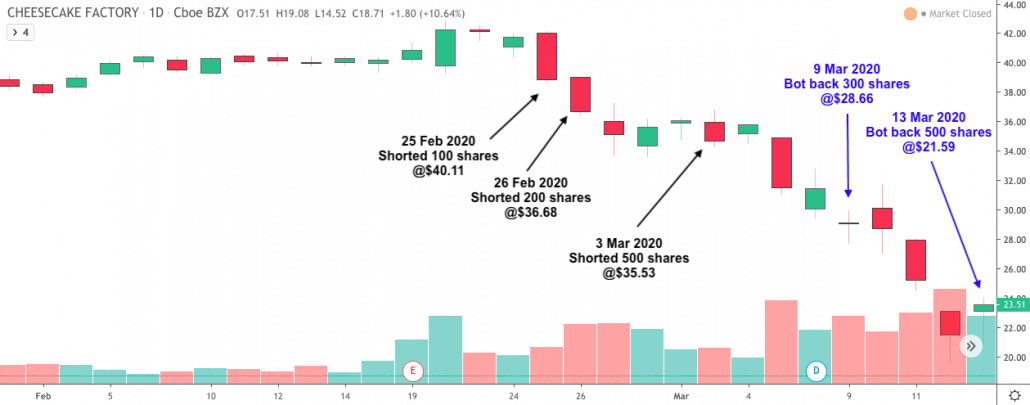

Cheesecake Factory (NASDAQ:CAKE)

A famous restaurant in the U.S. and also a distributor of cheesecakes. Probably not a good time for business if everyone is staying at home.

Robin shorted a total of 800 shares of Cheesecake Factory over 3 weeks, trades detailed in the chart below. Click the image to enlarge:

The total gain was S$16,156.

Boeing (NYSE:BA)

This company needs no introduction and their 737 max is a major problem which has not been resolved. The coronavirus dealt them another blow given that air travel will reduce tremendously and airlines might have to delay orders from them.

Robin shorted a total of 120 Boeing shares over a 3-week period. Trades detailed in the chart below. Click the image to enlarge:

The total gain was S$13,471.

Gold

Of course he didn’t get every trade right.

He was bullish on gold and had long positions on it.

He was bought 535 ounces of gold and closed all position within 3 weeks. He had initial gains until gold prices turned bearish too. Well, you win some and you lose some.

Trades detailed in the chart below. Click the image to enlarge:

Overall, it is still a very impressive results to make significant profits while many others are losing money.

But short term trading is not for everyone.

It may look easy because Robin is a very experienced trader. Please do not attempt to do this at home if you are a newbie. Also, his trade sizes are huge relative to what most traders’ capital, so you may not be able to replicate as much gains as he does.

You can meet him in person and find out more about how he trades.

Yeah, I agree.

Anyone can come up with a spreadsheet of P/L. Show us verifiable account statements.

You can go to his office to see for yourself. And don’t bother reading if you are skeptical.