After witnessing the fall in Asian stocks and remained pretty unscathed from the carnage, the U.S. stock market finally responded to the impact of Covid-19 in the past few days.

Major U.S. indices declined more than 10% in a week.

I don’t know what exactly spooked the investors. It could be the spread of the virus to Italy or it could be the major U.S. companies issuing warnings of lower profits due to production shut down in China.

Whatever it is, the fact is that the selling continues at the time of writing. Could this be the start of the stock market crash that many have been talking about?

Recently I did a poll in two of our Facebook Group. I asked if they would buy, sell or hold stocks during this period. The result was an overwhelmingly buy.

It seems like investors still have cash to deploy and most are looking to buy than to sell.

Does it mean it is not going to crash since there are more buyers supporting the price?

The truth is that most of our predictions are wrong.

Not just us, the experts too.

Roubini predicted 2013 was a “perfect storm” for the stock market. It rallied.

Marc Faber predicted in 2017 that stocks would fall by 40%. It rallied.

So I really do not know if the market will crash. We would have missed out so much gains if we have followed the predictions.

I tried to be naughty by spooking my wife saying the markets dropped a lot and her STI ETF gains might have been wiped out.

She replied happily that she hopes the markets will go lower because she can dollar cost average it down and buy more units at cheaper prices. She isn’t looking to sell as she doesn’t need the money.

She sounded like Warren Buffett who said similar things responding to the market drop a few days ago.

“That’s good for us actually, we’re a net buyer of stocks over time. Just like being a net buyer of food – I expect to buy food the rest of my life and I hope that food goes down in price tomorrow. Who wouldn’t rather buy at a lower price than a higher price? People are really strange on that. They should want the stock market to go down, they should want to buy at a lower price. They just feel better when stocks are going up”

Warren Buffett

Maybe my wife is a closet Warren Buffett.

She isn’t a sophisticated investor and she doesn’t pick stocks at all or do any market timing. But somehow she had the right attitude and perspective towards investing. Skill is overrated. Temperament is underrated.

If we take a helicopter view of the markets, a bull run has an average 164% return.

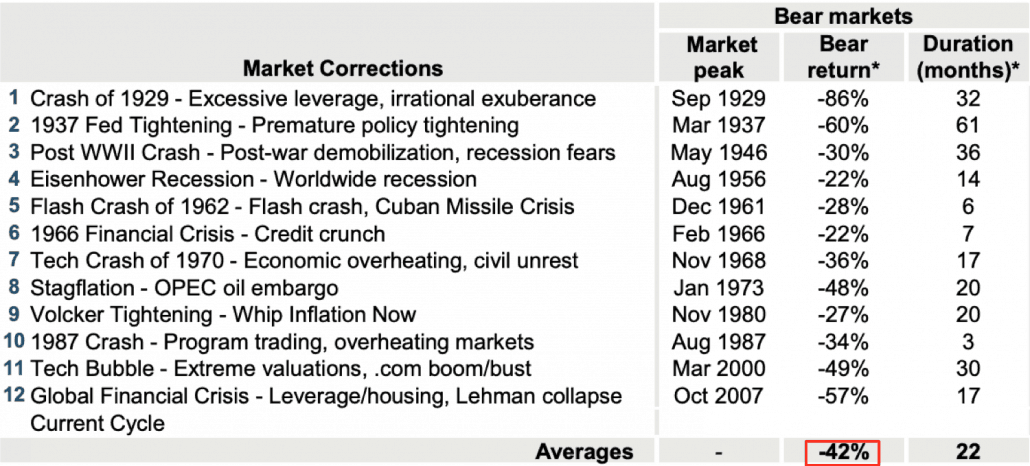

While a bear market drops by an average of 42%.

It doesn’t make sense to give up 164% gain to avoid a 42% loss by sitting out of a bull run.

Investing is easy, staying invested is hard. Many people claimed to be long term investors but use a few days of price movements to decide to sell:

Maybe you have trader friends who warn you not to catch a falling knife and better to get out of the market until the indicators say it is time to enter again. It is ok to have different views about the market but most importantly you need to decide if you are a trader or an investor. Don’t be an investor one day and a trader on another day. You would be surprised how many people behave this way.

Recently I learned about Vierodt’s law from Morgan Housel’s article and I shared it on Facebook. Long term investing is hard because a few bad days can feel longer than a decade of bull run.

Do you discuss specific stock? What is your take of Sembcorp having corrected close to 32% since start of the year?

Your calculations are off in terms of simply subtracting percentages like that.

From 100 to 200 is a 100% increase. Then from 200 to 100 is a 50% drop. But you netted 0 dollars and not a 50% gain.

Timing a bear market has indeed though proven to be more luck than knowledge 🙂

haha, you are good with numbers. It of course depends on the total amount made in the bull run. For the case in US, the runup is about 300%. So a 50% drop would still be profitable. If it is in Asia, likely to lose money overall.

But that said, if one holds through more than one cycle, there’s a high chance he would come out ahead.