For a long time now, U.S. fast-food chains like McDonald’s, KFC and Wendy’s have had a commanding presence all over the world.

However, there seems to be one Asian competitor set to shake up the industry as it executes an ambitious growth strategy and it is none other than Jollibee Foods Group.

Jollibee Foods Group (JFC: PH) is the parent company for the Philippine-founded fast-food chain and over a dozen other brands. They recently expanded to Singapore and have received raving reviews from many customers.

We got curious. We liked the food. But will we like the company as an investment?

With a combined store network closing in on 6,000 outlets across more than 20 countries, it’s only fitting we take a closer look at the company.

Introduction

With its origins dating back to 1975, Jollibee started as an ice cream parlour in Quezon City, Philippines. It wasn’t until three years later when the famous fast-food chain officially commenced trading.

Known for its distinctive menu including sweet spaghetti and fried chicken, the business made an instant impression with locals. A series of franchises sprung up and the business surpassed McDonald’s in the Philippines market.

With its resounding success at home, the business was exported to nearby countries in Asia and the Middle East during the 1980s and 90s. Since then, the company’s widely praised food has been welcomed into other Asian markets, North America, Europe and Oceania.

Aiding the company’s expansion has been an acquisition strategy where Jollibee Foods Group has attained the rights to brands such as Dunkin Donuts in China, Hard Rock Café in Hong Kong and Vietnam, Smashburger in the US, and Burger King in the Philippines – to name a few.

More than forty years after first opening its doors, Jollibee’s growth is showing no signs of slowing. In fact, it is accelerating. Last year Jollibee set a company record, opening more than 500 stores – well above one outlet per day, including locations like Milan, London and Manhattan. It’s all part of an aggressive target to become one of the top five global fast-food chains.

Just the month before (Sep 2019), Jollibee also officially completed its largest-ever purchase – a US$350m acquisition of The Coffee Bean and Tea Leaf – California-based speciality coffee chain with nearly 1,200 stores in 27 countries.

While we admire the company’s zeal in its dynamic stores’ expansion and acquisition plans, we can’t help but wonder if Jollibee has over-stretched itself from the rapid growth of the business. With that in mind, we will evaluate the viability of Jollibee’s shares using our Dividend Growth strategy;

- What is Jollibee’s gross profitability?

- Determine the attractiveness of JFC’s dividend yield

- Determine the sustainability of JFC’s dividends

- Conclusion: Is the stock worth buying?

For a quick background, the Dividend Growth Strategy is a quantitative approach to analyze stocks based on its numbers and proven to bring you market-beating returns. You can read more about the strategy at our Factor-Based Investing Guide.

Let’s take a closer look.

#1 – What is Jollibee’s gross profitability?

Robert Novy-Marx, a Rochester University professor, discovered that the Gross Profitability ratio offers an accurate way of determining future investment returns. His empirical studies proved that stocks with high Gross Profitability can have equally impressive returns as with value stocks and documented his research in The Other Side of Value: The Gross Profitability Premium.

Gross Profitability = Gross Profit/Total Assets

According to his research, companies that use fewer assets to produce higher Gross Profits are generally considered to be more productive and offer more quality than their competitors.

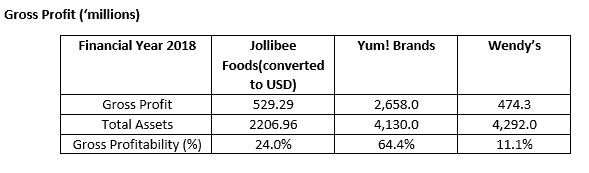

To assess how Jollibee Foods Group fares in this area, we’ve compared it against Yum! Brands (NYSE: YUM) and Wendy’s (NASDAQ: WEN).

We have omitted McDonald’s (NYSE: MCD) due to its sheer size and feels that the other two leading fast-food businesses would give a better comparison for Jollibee.

Between the trio, Yum! Brand has the best utilization rate of its assets when producing a gross profit. While Jollibee’s assets are about half of its peers (in USD), it does have a better record than Wendy’s and subsequently, generates higher gross profit.

Let’s now evaluate Jollibee’s dividend yield.

#2 – How Attractive is Jollibee’s Dividend Yield?

Unlike high-end restaurants, the fast-food chains segment is generally counter-cyclical because people will tighten their belts and go for such food during economic hard times.

As such, these stocks typically pay a modest dividend yield to investors. You can determine the historical dividend yield by taking:

Notwithstanding the low dividend yields across the 3 companies, Jollibee’s dividend yield of 1.2% trails its peers by a small amount.

This should not come as a surprise because Jollibee is allocating a significant sum of capital for expansion and acquisitions, so its payout ratio will be somewhat subdued.

In any case, the sustainability of these dividends is something to consider as well and we will delve into it next.

#3 – How sustainable are Jollibee’s dividends moving forward?

The sustainability of a company’s dividend distribution can be measured using two indicators:

- Average Free Cash Flow Yield

- Payout Ratio

We can evaluate Jollibee’s Free Cash Flow Yield by deducting capital expenditure from operating cash flow.

Given its growth strategy, it is reasonable to assume that Jollibee regularly invests in new assets to support its international expansion. We will look at data from the last 3 years to validate this.

Average Free Cash Flow: PHP 3,205.1

Average Free Cash Flow Yield;

Average Free Cash Flow/market capitalization of shares -> 3,205.1 / 240,588.6 = 1.3%

Over the last three years, the average cash flow yield of Jollibee is 1.3%. This is marginally higher than the current dividend yield of 1.2%. With such a small headroom, investors have to question if the current yield can improve or even be sustained in the first place.

On the other hand, investors should take note of 2 important points too.

Firstly, at the time of writing, the company’s market capitalization is significantly less than the peak achieved in Jan 2019 at PHP 324.80. Since then, the company’s stock price has declined more than 30% to PHP 220.20. Therefore, the average free cash flow yield is higher than what it previously was before the share price decline.

Secondly, the trend over this period shows a declining free cash flow. This is noteworthy as Jollibee has signalled its plans to almost double its capital expenditure in the near future by piling on debt.

Hence, free cash flow is in a dangerous spot to go negative amid all the expansion plans in place. On a bright note, Jollibee’s acquisitions and investment into its store network could help substantially increase operating cash flow and mitigate the impact.

Payout Ratio

The payout ratio can be calculated as per below:

Dividend Payout Ratio = Dividends per Share / Earnings per Share

We can form some insights on this by looking at the payout ratio for Jollibee Foods across 3 years. Ideally, a good payout ratio needs to be contained below 1x.

From what we can see above, Jollibee’s dividends can be sustainable given its low payout ratio at around 30%.

In addition, we see that the company has grown its earnings significantly year-on-year, which has enabled it to increase its total dividend payments from PHP 1.86 in FY2016 to PHP 2.48 in FY2018; while maintaining a consistent payout ratio.

The Qualitative Side

The following qualitative metrics will help us analyze the attractiveness of an investment in Jollibee:

- Moat (Competition)

- Ownership

Moat

With its operations spread all over the world, the brands that makeup Jollibee Foods Group face an extensive level of competition. While Jollibee has cemented its position in the Philippines as a fast-food market leader, the same cannot be said elsewhere.

The company is aiming to grow total revenue from US and China operations to 30% each over the next decade – up from current levels of 15% and 12% respectively. However, these markets are saturated with intense competition from bigger chains that have greater economies of scale, longer experience in the market, and a better understanding of their consumers’ preferences.

Jollibee’s recent M&A activity and new store openings are necessary to propel the company to greater heights. However, recently integrated brands like Smashburger and The Coffee Bean and Tea Leaf are running at significant losses and these will continue to drag on earnings for some time.

One thing the company does have in its favor is the popularity and novelty of its unique food. This is the distinction that separates Jollibee from competing brands.

While established brands cater to American tastes, the Philippine-based company promotes more exotic sweet and spicy flavors. In fact, I have watched interviews of Jollibee’s CEO and he talked about how they intend to penetrate foreign markets by targeting the Philippine expats in those countries first and then slowly expand and strike a chord with the other foreigners.

To summarize, we can say that Jollibee has a strong foothold in its own country but lacks any decisive economic moat overseas. It is still debatable if the company can make a meaningful impact in its key foreign markets.

Ownership

One of the key things we look for in a company’s ownership structure is the number of shares held by its directors or management team. To ensure alignment with shareholders, this should be a sizeable proportion, but also not exceed 70% so as to mitigate the risk of the company being subject to a discounted privatization.

Jollibee’s current ownership structure is as follows:

The principal shareholders in Jollibee are Hyper Dynamic Corporation and Honeysea Corporation – two Philippine-based companies – with a combined stake of 36.67%.

When we further dug into the beneficial owners of the 2 companies, we found out that they are owned or controlled by the Founder and Chairman Tony Tan Caktiong and his relatives. Coupled with his direct stake of 0.78% of outstanding shares, his total interest in the company stands at a good 37.45%.

Conclusion

To sum up, there is insufficient appeal to invest in Jollibee as a dividend growth stock. While the company’s growth profitability fares reasonably at 24%, the dividend yield remains underwhelming at 1.2%.

In addition, the steep decline in free cash flow and expected huge increase in capital expenditure puts the sustainability of (historical) dividend growth at risks although Jollibee’s dividends payout ratio has always remained at a low and manageable 0.32x.

Lastly, Jollibee will face heightened levels of competition on all fronts until it is able to entrench its position in key overseas markets. Until that time, we opined that Jollibee is one stock that appears to be overrated as its latest acquisitions are likely to hold back short-term performance.

Editor’s Notes: A majority of retail investors often fall for brand recall traps. That is, that they buy stocks of known big brands in the markets such as Singtel, Starhub, M1, Hyflux, and Noble. We have staunchly stood by the fact that investing in such a manner is a tragedy in the making. Hyflux’s and Noble’s demise as well as the subsequent underperformance of the major telcos so beloved by retail investors stand as testament to that fact. Always let the fundamentals guide you.

Our investigation into the company’s financials have disappointed us. They may yet stun us. I wouldn’t take a bet against them given that their food is great and Singaporeans are drawn to good food like moths to a flame.

For now, we’ll pass on investing in this. This is yet again another example, of why you should double check the financials of a company even if you like the business and the quality of its products. Good products does not always equate good financials and good performances.

Market forces will always strip the business down to size if it fails to drive profits. Such is capitalism. If you are interested in how we use these fundamentals to hunt stocks that can deliver truly life changing capital gains, you can register for a seat here to see a live demonstration.