In my previous article, I talked about how small retail traders can make money and mentioned that I will share more on how to read market structure, how to trade pullbacks etc in my future postings. I think the recent falling Gold price will make an excellent case study and I have personally traded on it too.

It is very common to hear gurus say, “Follow the trend. Don’t fight the trend. If it’s uptrending, buy on pullback. If it’s downtrending, short on pullback”. A pullback is a move against the prevailing trend. In our example – a pullback in a downtrend means a bounce up against this falling price and is an opportunity to enter a short position.

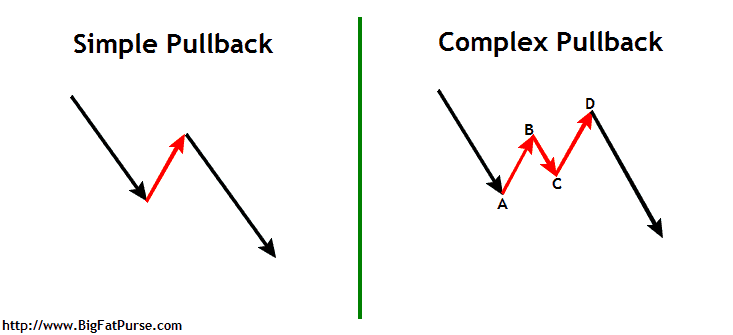

But they never tell you that it’s not that easy to trade because there are different kind of pullbacks: Simple Pullback & Complex Pullback

A simple pullback is pretty self-explanatory (diagram below). After an impulse move down, it will usually go into a pullback, which is a counter-trend movement. Once the pullback has finished, price will resume its impulse move down again.

A complex pullback is basically a two-legged pullback that has a complete ABCD structure.

It is important that you recognize between simple and complex pullbacks when you see them in a chart. In a trending market, it is common for pullbacks to alternate between simple and complex. Thus, you must be able to anticipate the possibility of a complex pullback, especially in a mature trend.

I am primarily a swing trader and my trading time-frame is based on daily chart. However, it’s very important to look at a higher time frame to give you a bigger perspective. Since I trade based on daily chart, my higher time frame would be the weekly chart. Sometimes, I will even look at the monthly chart to provide a even bigger picture on the likely trend and movement.

Let’s take a look at the WEEKLY Gold chart below during mid-August. Back then, I wrote a posting in a private forum suggesting that Gold could be doing a complex pullback. Gold has been in a very clear downtrend. However, the pullbacks were just consecutive simple pullbacks. So by August, I was anticipating that a complex pullback could be making in the process. Of course, there was no certainty in trading but I was waiting and getting ready to place my shorts once price action suggested that it could be resuming its downtrend.

By late August, there were finance sites proclaiming that Gold had started to turn up and gave reasons “why a major gold uptrend starts now”. Here’s the article but I won’t hyperlink to it: http://www.lewrockwell.com/2013/08/clive-maund/3-reasons-why-a-major-gold-uptrend-starts-now/

I don’t trust analysts’ views when it comes to trading. I trade solely based on my own judgement. Also, I am a pure technical trader and fundamentals has no room for me when I swing trade (well, you may disagree). You can tell me how “valuable” Gold is or how Gold is “real money” or how Gold “shouldn’t keep falling” based on fundamental analysis, and I will NOT buy into that.

I was still bearish on Gold, so I tried to look at the monthly chart (below) to give me an even bigger context. It was an impulsive downward move. So a pullback was very normal. But my view was that once the pullback has finished, Gold will continue its downward move. All in all, I was still very bearish on Gold and the direction was clear to me, which was downtrending.

However, a clear direction does NOT mean it is easy to trade.

You will need to enter at the right place at the right time because you want to keep your stop loss relatively tight so that your risk/reward (R/R) ratio will be favourable. You could be stopped out before it moves in the direction you want. That happened to me.

My first short was a tad too early and I was stopped out. My first short was a loser. However I treat each trade as an independent trade and I do not let this losing trade affect my next short position. Every trade is also position-sized with pre-defined risk (amount of dollar).

By September, this complex pullback from Gold played out nicely and I managed to catch this wave of sell-down (I was lucky). My next 3 shorts were winners. Overall, I had 3 winners and 1 loser. My R/R ratio was about 1 : 2.4 for my winning trades. The chart below showed my entries and take-profit (TP) levels.

Now you may be asking, “Alex, if you know Gold is downtrending, why don’t you just hold your short position all the way from $1410 to $1270?”

Well, Mr Market does not care about my view or opinion. There is no absolute certainty in trading. If I knew my trade would be a sure-win, I would have sold my house and dumped all my money into shorting Gold and I would be a billionaire by now. The movement in price may not be played out according to my anticipation and I also do not know how long the trend will last.

It is very difficult to trade in real-time. Trend is always the clearest on hindsight…. but you can’t make money on hindsight!

NOTE: As of writing, I have no position in Gold and have since closed all my short positions.

Yes there is fundamental reason to buy gold. Cost of production for gold is average 1300. Conservative level to buy gold is below 1300. Since US debt ceiling problem has been postponed to Jan 14 then they are not likely to taper QE. This will result in USD weakness and gold price rising.