Back in 2010, I picked up “The Little Book that Beats the Market” by Joel Greenblatt. At first, I thought it was a casual finance book that I could breeze through quickly, but I was wrong. It contains valuable information presented concisely. Short and sweet.

I’ll be sharing what I’d learnt from the book, explore more about the Magic Formula and share a free tool that allows investors to screen for Magic Formula stocks in several countries.

I had recorded a quick masterclass on Magic Formula Investing, you can watch it here:

The “Magic Formula” sounds like a hyped up, get rich quick concept. But, it’s actually a legit (and relatively famous) value investing strategy devised by Joel Greenblatt.

- Who is Joel Greenblatt?

- What is Magic Formula Investing?

- Does the Magic Formula work?

- How to implement the Magic Formula?

- Where to find Magic Formula stocks?

- How to screen for Magic Formula stocks?

- Top 10 Singapore Magic Formula stocks listed in SGX

- 2 things to look out for when implementing the Magic Formula

- 3 Caveats for investing with the Magic Formula

- Conclusion

Who is Joel Greenblatt?

A hedge fund manager and adjunct professor at Colombia Business School, Joel Greenblatt runs Gotham Funds, an equity management firm.

Although he isn’t as famous as Warren Buffett or Ray Dalio, Joel Greenblatt is one of the forerunners in modern value investing. He designed a system to invest in stocks that consistently beat the market averages, which he coined the “magic formula”.

He first introduced the Magic Formula in his book, The Little Book that Beats the Market.

What is Magic Formula Investing?

In a nutshell, the Magic Formula is about buying good companies at bargain prices.

It combines the best value investing ideas from both Benjamin Graham (buying cheap businesses) and Warren Buffett (buy wonderful businesses).

Now, many of you would be skeptical – how can there be a magic formula? If only life could be so simple.

Well, the magic formula rules are simple, but they are also reasonable and logical. The application is where it gets tricky.

Hence, there are just 2 rules to Magic Formula Investing:

- Find Good Companies – the Magic Formula defines a good company as one with High Return on Capital.

- Find Cheap Companies – the Magic Formula defines a cheap company as one with High Earning Yields.

Let’s see how these work:

#1 – Buy Good Companies: High return on Capital

The primary purpose of businesses and companies is to maximise the returns of their working capital. Business owners must know how to deploy their funds effectively. Hence, it makes sense to buy stocks of companies that can make the most profit with the least capital.

Here’s an insightful quote from the book:

“Buying a share of a good business is better than buying a share of a bad business. One way to do this is to purchase a business that can invest its own money at high rates of return rather than purchasing a business that can only invest at lower ones. In other words, businesses that earn a high return on capital are better than businesses that earn a low return on capital.”

#2 Buy cheap stocks at bargain prices, with High Earning Yields

Greenblatt mentioned Benjamin Graham’s concept of “Mr Market”. He opined that “Mr Market” is irrational in the short term, but in the long run, he actually values stocks close to their true value.

There are times to exploit Mr Market’s unstable emotions; that is, to buy from him when he is depressed about stocks. In this way, you can buy the best companies at a low price.

To quote the book,

“Paying a bargain price when you purchase a share in a business is a good thing. One way to do this is to purchase a business that earns more relative to the price you are paying rather than less. In other words, a higher earnings yield is better than a lower one.”

The Math of Magic Formula Investing

With these rules in hand, the next common question that investors would ask is “how high is high?”;

This is how Greenblatt determines stocks that fit the criteria:

- Return on Capital = (pre-tax operating earnings)/(tangible assets employed or Net Working Capital + Net Fixed Assets)

- Earnings Yield = (pre-tax operating earnings)/(enterprise value = market value of equity* + net interest-bearing debt)

*including preference shares

Does the Magic Formula work?

Joel Greenblatt has published his results in his books previously:

The tables show the results of maintaining the top 30 stocks for 17 and 22 years, respectively. We can see that Magic Formula Investing continued to beat the S&P 500 index, even after the 2008 crash.

The formula remains robust today. Although I don’t have access to Greenblatt’s official results after 2010, it has been covered by various investors. You can find results from other investors if you do a quick Google search.

How to implement the Magic Formula?

Now, understand that the Magic Formula gives us a relative valuation, rather than an absolute one.

This means that instead of giving you the absolute value of a stock, the Magic Formula works more like a ranking system – it helps you rank for the good companies at cheapest prices, from a basket of stocks.

To implement it, you’ll need to:

- Calculate the Return on Capital and Earning Yields of all the businesses in your basket of stocks

- Rank the stocks based on both criteria

- Buy the top 30 stocks

- Repeat your analysis annually, updating your portfolio with new list of top 30 stocks.

(Skip to 13.00 of the video above for an example)

Where to find Magic Formula stocks?

Good news – you don’t have to do the calculations or ranking manually.

Instead, there are free screeners available for you, I shared 2 of them in my talk;

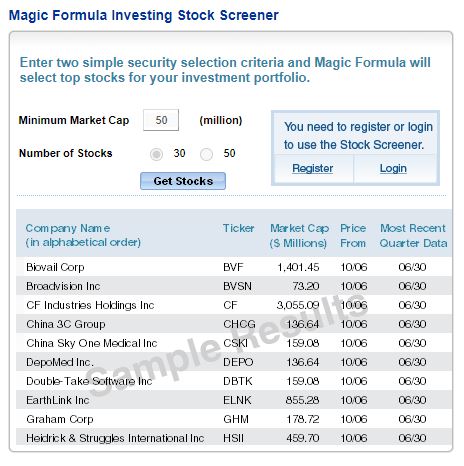

1 – Magic Formula Investing

The official website for the Magic Formula is managed by Joel Greenblatt and comes with a screener. All you need to do is to sign up for a free account.

The downside is that it is limited only to US stocks.

2 – Dr Wealth App

[Update: The Dr Wealth App has been decommissioned as of Jul 2022]

Our webapp also comes a Magic Formula screener, it is built based on the formula in Greenblatt’s book.

The best part? It’s free to use, without having to sign up for an account.

At the point of writing, this screener covers the Singapore, US, Hong Kong, China, Vietnam, Indonesia, Malaysia and Japan markets.

In the next section, I’ll go through the steps to screening for Magic Formula stocks.

If you prefer to watch my demonstration via the Dr Wealth app, watch the above video from 19.00 onwards.

How to screen for Magic Formula stocks?

- Go to Dr Wealth App.

- Click on ‘Discover’ icon at the bottom of screen.

- Choose ‘Magic Formula’.

- Select the market(s) you want to invest in.

- Tap ‘Done’.

This is a web app, you do not need to download it. It is accessible on any device via a browser:

Click on the ‘Discover’ icon at the bottom of your screen to view our range of screeners.

To select the market(s) that you’d like to screen in, tap on the funnel icon (top right).

Once you’ve load the Magic Formula screen, you’ll see a list of stocks, their ranking, as well as their Earnings Yield and Return on Capital.

If any stock piques your interest, you can tap the stock name to see more details such as;

- Financial Metrics: Price to Book, Dividend Yield, Return on Equity, etc

- Company Information

- News: as pulled from top new sources like Business Times, The Edge

- Additional Analysis: if specific analysts cover the stock, you’ll see their reports in the app

That’s basically it. You can select the Magic Formula stocks based on the list, or choose to analyse each company further by clicking into it.

Prior to the live session, I had not taken a look at the latest list of Magic Formula stocks. Hence, I was pleasantly surprised to find some new ideas during the session. I highlight some of the here:

Top 10 Singapore Magic Formula stocks listed in SGX

| Company | Stock Code | Magic Formula Ranking | Return on Capital | Earnings Yield | |

|---|---|---|---|---|---|

| Medtecs International | SGX:546 | 235 | 60.94% | 83.70% | |

| Shen Yao Holdings Ltd | SGX:A78 | 324 | 41.55% | 150.65% | |

| Jiutian Chemical Group Limited | SGX:C8R | 412 | 42.47% | 62.60% | |

| Best World International Ltd | SGX:CGN | 574 | 60.38% | 29.77% | |

| Fortress Minerals Ltd | SGX:OAJ | 655 | 56.80% | 27.37% | |

| Union Gas Holdings Ltd | SGX:1F2 | 684 | 39.81% | 32.19% | |

| Azeus Systems Holdings Ltd | SGX:BBW | 793 | 26.53% | 127.61% | |

| Jackspeed Corporation Limited | SGX:J17 | 815 | 4164.59% | 21.18% | |

| AEM Holdings Ltd | SGX:AWX | 834 | 80.43% | 21.95% | |

| PropNex Limited | SGX:OYY | 849 | 40.46% | 25.89% |

2 things to look out for when implementing the Magic Formula

The Magic Formula is a quantitative, data-driven method to picking stocks. Hence, if you are trying to implement it on your own, there may be a few issues you want to take note:

1) Don’t nitpick

Joel Greenblatt warns against nitpicking from the pool of Magic Formula stocks because this process tend to introduce biases which may work against us.

The best way to implement the Magic Formula is to buy the best stocks on the list, at equal weights.

That said, investing requires conviction. It is easy to get cold feet and end up selling at a loss when the markets go down. Hence, most investors will inevitably do some sort of nitpicking when trying to implement the Magic Formula.

In my opinion, the process of ‘nitpicking’ tends to give investors more confidence over their choices, hence it is difficult to avoid it.

Since you’re most likely going to be nitpicking, might as well…

2) Improve your picks with Qualitative Analysis

A quantitative screen analyses companies based on the numbers they release.

Unfortunately, this means that it is not able to tell the quality of the business, detect competitive advantages, determine the competitors, decide if the management is good or not.

So, if you plan to nitpick, put in the extra effort and time to carry out qualitative analysis to understand the business(es) better.

3 Caveats for investing with the Magic Formula

It may sound easy to “buy the best companies at bargain prices.” But how do you actually do it?

Being a responsible person, Greenblatt did state the imperfections of the system.

1) You need to be consistent over the long term

For the magic formula to work, you need to do it for at least three years!

The following quotes from the book should shed light on why this is so:

“In fact, on average, in five months out of each year, the magic formula portfolio does worse than the overall market. But forget months. Often, the magic formula doesn’t work for a full year or even more.”

“Though the process doesn’t always work quickly, two to three years is usually enough time for Mr. Market to get things right.”

“Most people just won’t wait that long. Their investment time horizon is too short. If a strategy works in the long run (meaning it sometimes takes three, four, or even five years to show its stuff), most people won’t stick with it. After a year or two of performing worse than the market averages (or earning lower returns than their friends), most people look for a new strategy— usually one that has done well over the past few years.”

2) It hedges on the performance of several stocks

One issue with the magic formula is that it hedges on the average performance of a basket of stocks. If you buy only 1 or 2 stocks of the top 30 stocks, your risk will be higher.

You would also need substantial capital to maintain 30 stocks at one time.

3) It is dependent on the projected profitability of companies

Another thing to consider is that it is difficult to predict the profitability of the companies in the future. No one can determine that, not even the professionals.

The best way to go about this is to base your estimates on past results. The key is to eliminate extraordinary items to normalise the earnings. If you do not know how to do so, you may get an inaccurate ranking of the companies.

Conclusion

In this article, I’ve talked about Joel Greenblatt’s Magic Formula, how it was devised, the criteria it uses to pick for stocks and how you can implement it.

I’ve also shared 12 free screeners that you can use to screen for Magic Formula stocks.

I hope this helps you to find more investing ideas.

All the best!

I love the app but I wish you included the U.S. market also. This app has more functionality than Joel Greenblatt’s site. After all, we all have our own home bias. Thank you

We are going to add US data soon. Try again in end Oct 2020!

Look forward to it, thanks!