The official retirement age in Singapore is 62. According to a study by the Lee Kuan Yew School of Public Policy, you’ll need S$1,379 per month(before inflation) to meet your basic needs as a senior in Singapore. As of 2020, Singstat reported that the average lifespan of Singaporeans is 84 years old. This means you’ll need at least S$364,056 to retire in Singapore.

That said, this estimate is highly hypothetical because the actual amount you’ll need for retirement depends on too many factors.

If you’ve ever wondered:

- Can I ever retire on my current salary?

- Can I afford to retire while caring for my parents?

- Can I afford to retire even after funding my child’s education?

This article is for you.

I’m going to attempt to clear all the doubt and uncertainty surrounding your retirement planning, help you determine your personal retirement goal amount, show how you can earn a $2,500 monthly paycheck from CPF after you’ve retired and share how you can build a dividend portfolio that pays you.

(this was first published in 2019 and has been updated in 2022.)

5 Factors that could affect your Retirement Budget

As mentioned above, the Lee Kuan Yew School of Public Policy’s study suggests that a senior in Singapore will need S$1,379 per month to meet their basic needs. So if you retire at 62 and live till the average Singaporean lifespan of 84, you’ll need at least S$364,056 to retire in Singapore.

But in our opinion, this is an underestimation because there are several key factors that’ll affect how much you’ll really need to retire comfortably.

These factors include:

- Inflation

- Health

- Ideal Retirement Lifestyle

- Your preferred form of entertainment

- Unforeseen events

Let’s take a look at each of these factors and how they will affect your retirement budget.

1. Inflation

Inflation affects how much buying power you’re losing every year.

For example, if you needed $4 today to buy $1 worth of items back in 1961 it means that, with $1 today, you can only buy $0.25 of items back in 1961. In reality it could be worse. $1 might fill your belly in 1961 but can only afford you a pack of SuperRings in 2022.

This is why we must account for inflation!

The average inflation rate from 1961 to 2021 has been 2.5%. If we assume it stays constant for another 30 years, that will be a 52.3% loss in purchasing power! In other words, your $1 now will be worth only $0.47 in thirty years when you want to retire!

Clearly, failure to account for inflation will see us suffer in the long term immeasurably.

2. Health

Medical bills will make up a significant chunk of your expenses as you get older, even if you’re a fitness geek.

I studied the latest Household Expenditure Survey by the Department of Statistics and found that on average, a retiree would expect to spend at least S$163.90 per month on health related expenses. If you’re curious, I shared my findings about what retirees in Singapore typically spend on here.

3. Ideal Retirement Lifestyle

This factor provides the greatest variance among retirement budgets. How you wish to spend your days after retirement will affect how much you need to retire comfortably.

A retiree who wants to enjoy a cup of artisanal specialty coffee every day will require a larger retirement budget than one who prefers to lim kopi at a kopitiam. A retiree who wants to drive rather than take the bus would also require a larger retirement budget.

4. Your preferred form of entertainment

This factor builds on the previous, but focuses on infrequent higher ticket items or experiences.

Wanderlust retirees will probably want to have a larger retirement budget than those who prefer to take walks. Same goes for those with a bucket list of Michelin starred restaurants.

5. Unforeseen circumstances

Now, this isn’t something you can plan for and is a deep topic for another article.

However, you’ll want to set aside an emergency fund and ensure that you have adequate insurance to help you cope with any unforeseen circumstances during your retirement, to protect your retirement funds.

How much you set aside here would depend on how financially secure you wish to be during your retirement.

How to calculate your personal retirement budget?

Now that we have a common understanding about the factors that could affect your retirement, you’ll probably want to know how much you need based on your situation.

Here’s a better way to determine how much you personally need to retire in Singapore on a monthly basis:

Imagine that you’re retired right now and…

- List down your daily expenses in today’s prices: food, utilities, transportation.

- List down possible high ticket items in today’s price: travel, entertainment, hobbies, etc

- Estimate your medical and insurance expenses

- [optional] Add a 1.5x multiplier to each line item as a safety buffer

Here’s an example of what it could look like:

Once you’ve done this, you’ll have a rough gauge of how much you need today, to retire peacefully years from now.

In the example above, that’s an average of $4700 a month for “retirement today”.

Why focus on “retirement today”?

Because retirement can be far off for some of us and can reasonably be expected to last about 20 years. Some even longer. Accounting for the figure of “retirement today” allows us to be more precise about how much we need years from now thanks to inflation.

Basically, we want to answer the question of: “Now that we know we need $4700 a month to retire today, how much is $4700 a month when we’re 80?“

Hence, we must account for inflation.

To do that, you can use this simple formula:

Expense/Month x 1(to the power of number of years till retirement)

Simply:

- Take the monthly amount you need

- Multiply it by 1 to the power of number of years till retirement

For example, I want to retire on $4,700 a month in 43 years. Assuming a more aggressive inflation rate of 4% (to be safe!), we can then take:

$4700 x 1.04 to the power of 43 to get the amount we need:

power of 43 = number of years of retirement.

Assuming we still want access to $4700 worth of purchasing power in the future, we will require $25,382.32/month in 43 years time. This is assuming a steady inflation rate of 4% a year. Even a modest target of $2500 monthly income will mean a sum of $13,501 a month!

For those who prefer learning by listening, I had shared what it’s like to plan for retirement at the age of 65:

Now how do we get that kind of money?

Assuming 4% inflation rate per year.

How To Retire Comfortably?

Now that you have a target in mind, it’s where the work begins. In this section, I cover three steps to a comfortable retirement.

#1 – Increase your saving rate

You’ve got to start somewhere. And for most of us, it’ll start with building your savings. Afterall, if you don’t have savings, there’s no way you can retire.

Here’re some ways you could save more:

- Watch your expenses, using a budgeting system might help.

- Increase your income (get a part time job, or start a side hustle)

- Increase your savings rate, consider bank accounts that offer higher interest rates

That said, the amount you’ve calculated in the section above must have shocked you.

You’re probably thinking it’s probably impossible to save that amount of money right now.

And you’re right.

It is impossible to save that amount of money.

But it is not impossible to grow that amount of money. (I’ve also shared why you cannot afford to skip investing here)

As I covered above, we should estimate inflation to be at about 4% in order to be safe. Hence, the easiest and most direct method to beat inflation, is to grow our own money at 4% a year OR more.

That way, your money can continuously work for you and grow for you in a meaningful way while beating inflation! This works regardless if you’re providing for your children and their education, caring for your parents or making sure you can retire peacefully.

The way to beat inflation is to grow your money at the same (or higher) pace.

Here’re two ways you can do that:

#2 – CPF Special Account (CPFSA): Between 4% to 5% returns per year.

CPF is Singapore’s version of a forced savings enforced on its citizens, it makes sure that we have at least some monies to retire on.

And the CPFSA is perhaps the most stable method of growing your money. Maximise the use of your very own, government guaranteed, CPF Special Account (CPFSA).

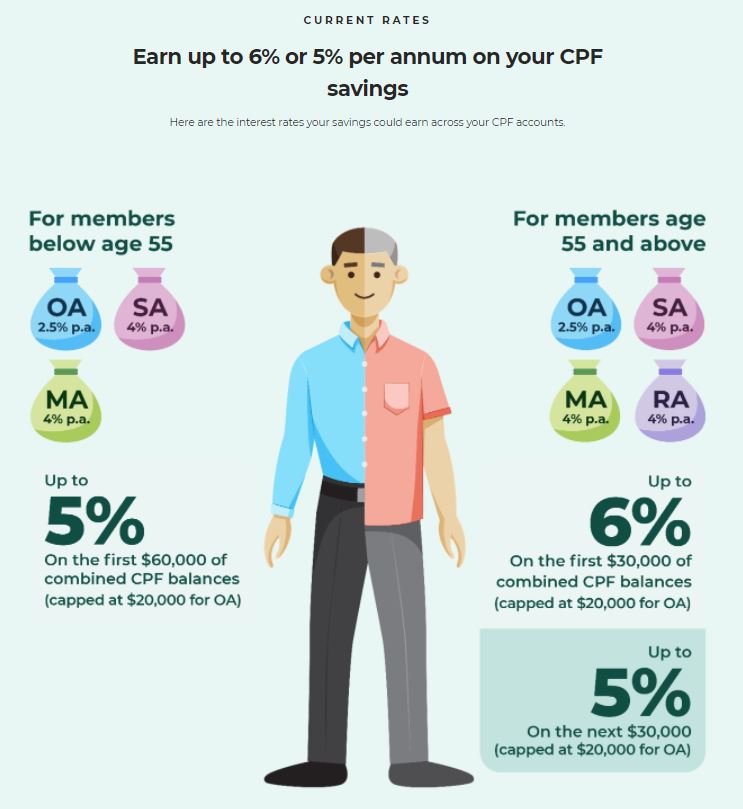

Monies in your CPFSA earn 4% interest year on year.

An extra 1% per annum interest is currently paid on the first $60,000 of your combined balances (with up to $20,000 from Ordinary Account). That means if you have $60,000 or more between your CPF OA and SA, your yearly returns on the 1st $60,000 in your CPF account jumps by an additional 1%!

Sounds meager but that’s an additional 30% over 30 years without even accounting for compound interest!

Assuming the floor rate of 4% for your CPF Special Account, $500 deposited in your CPF Special Account every month will accumulate to $343,756.98 in 30 years.

Assuming your ordinary account has zero dollars, with $343,756.98 forming the whole of your Retirement Account, you will receive about $2,500 a month upon reaching age 65.

For most people, this should prove to be sufficient to cover at least your basic needs such as food and transportation. For the thrifty, these might even pay for your day to day luxuries such as movies or even a regular trip to Malaysia.

CPF Account Allocations

Something important to note: most people will not automatically have $500 deposited into their CPF account every month. This is due to how the government allocates the money in your CPF account.

As a rule of thumb, your salary needs to be approximately $8,333 a month in order to have $500 a month deposited into your CPF Special account. If your current salary does not match this, it’s fine. You can just perform a manual top up to make up the difference.

For example, if your salary is $3,000, and you’re below 35, 6% of your salary will go into your CPF Special Account. 6% of $3,000 is $180. You will have to top-up $320 every month to make up the shortfall manually.

You can find out more about your CPF allocations here.

Drawbacks of relying on your CPF Special Account

I would be failing you if I did not warn you of the potential danger to you if you chose to rely entirely on your CPF Special Account in order to retire.

Here are some of the issues you will face with relying solely on the CPF Special Account as your means of growing your money:

- Inflexibility: You have no control over your money. It is not accessible in the case of emergencies such as an operation or going for a Masters in the field of your choice.

- Long wait time: You need to wait till you’re 65 before you can see that money come to you bit by bit, a month at a time.

- Returns are Capped: Your returns are a maximum of 5% a year. It doesn’t go up unless the government says so. And if the government says so, it might go down as well. If inflation rises above 4%, your CPF Special Account won’t be able to account for that.

- Currency Risk: The Malaysian Ringgit was once worth $0.50 Singapore dollar. Today, it’s 1 Malaysian Ringgit to $0.31 Singapore dollar. If the same happens to Singapore’s currency, money locked away in the CPF Special Account prevents you from shifting your cash into an asset (eg. gold) that can retain its value far better.

If you’re fine with all of the above risks, go for it! After all, in return for having to put up with those risks, you get a guaranteed 4% a year. It’s fuss free, not very complicated and reasonably safe.

#3 – CPF LIFE payouts at age 65

At age 55, your CPFSA will be combined with your CPF Ordinary Account (OA) to form your Retirement Account (RA) which you can start withdrawing your CPF savings from. If you do not withdraw, your CPF savings will continue to grow at 4%.

Then at age 65, you unlock the monthly CPF LIFE payout.

According to CPF, here’s how much monthly payout you can get:

| Savings you need at 65 | (estimated) Monthly Payout from 65 |

|---|---|

| $60,000 | $350 – $370 |

| $95,000 | $530 – $560 |

| $145,000 | $770 – $830 |

| $180,000 | $940 – $1,010 |

| $285,000 | $1,450 – $1,550 |

| $300,000 | $1,520 – $1,630 |

| $425,000 | $2,120 – $2,280 |

As of 2018, there are three types of CPF LIFE payout plans which will affect your payout amount. Louis shares more details in this guide: CPF LIFE: How to get the most payout.

CPF is great. But you don’t want to put all your eggs in one basket and rely solely on CPF as you’ll never know if policies might change. So, another good way to secure your retirement is to build your own income stream. Here’s how.

#3 – Dividend Investing

Dividends investing sounds complicated but it’s actually really straightforward.

3 steps to successful dividend investing:

- Buy stocks of good companies that pay dividends (this means you get cash every year for being owners of their stock).

- As you own more and more stocks, your dividends grow and grow. Especially when reinvested and allowed to compound over time.

- Soon enough, your dividends will actually exceed your take-home pay, at which point you can retire peacefully.

The question then becomes: which stocks do you buy?

Trying to address that question within this post will be rather impossible. We cover more in our free dividend investing guide.

Or, you can join me at my upcoming live ERM webinar. I’ll be sharing how I built my dividend portfolio which funds my retirement currently, and how you can structure yours in today’s markets.

Start working on your retirement

Don’t just read this article and be done with it.

Go through the exercise above, account for inflation and find out how much you personally need to retire in Singapore. Then plan your route to retirement.

And most importantly, take action.

Increase your savings rates, understand how CPF works and put it to work for you, then learn to invest. We have a collection of investment guides and a range of free investment courses that’ll help you get started too.

Cpf contribution cap is $6000

Hi Cyrus, you can transfer a portion or even the entirety of your CPF-OA to your CPF-SA to make up for the shortfall.

Hi, thanks for the great article. I would like to clarify for the illustration of the retirement account of $343,756.98 at age 55 to receive about $2,500 per month, is this practical? I thought there is a cap to the enhanced retirement sum in the retirement account, e.g. current cap is at $264,000 and even if we have more funds in the CPFSA, we are not allowed to transfer them over to the retirement account to get higher monthly CPF Life payout?

hi! You’re right! Even with $264,000, you would be paid approx. $1960 to $2110. I think you’re able to draw out the remainder of the sum saved as well, so that extra cash can be safely invested in a dividend passive income portfolio to supplement your cpf monthly pay out.

Is it possible to leave the balance after the $264k allocated to annuity in your RA to earn the 4% interest ?

Hi Abby,

Yes. this is possible. Remaining balance in SA after set aside minimum sum to RA will get 4% interest

Regards

Louis Koay

Very generic article with some good ideas but without much consideration for the specifics of our CPF system.

Contribution cap is 6k, there is also a limit on how much you can transfer from ordinary to special account.

$2500 x 1.04 to the power of 25(years of retirement)= $13,501.

isn’t that $6664.59?

Assuming we still want access to $4700 worth of purchasing power in the future, we will require $25,382.32 a month in 43 years time every month. This is assuming a steady inflation rate of 4% a year.

That means $25,382.32*43=$1,091,439.76 sum of money when you stop work at 55? to live to 98?