Every month, a portion of your salary goes into CPF. It's only natural that you'd want to get back as much as possible.

You now have 3 CPF LIFE payout options to choose from. How do you know which will give you the MOST returns?

I will break down your options in this article:

this article was first published in 2018, it has been updated for 2022

CPF LIFE Payout Options

As of 1st Jan 2018, Singapore citizens and PR have 3 CPF LIFE payout options to choose from. Here's an overview:

Source: CPF

Every retiree has different needs and should opt for a payout option most suited for yourself.

At the same time, we also want to achieve the highest possible return from our CPF.

Which of these three plans offer the highest return? Read on to find out.

What is CPF LIFE?

Before we jump into the plan with the best return, here's a quick introduction to CPF LIFE.

When you turn age 55, a Retirement account will be created with savings from your Special Account (SA) and Ordinary Account (OA).

Source: CPF

You need to set aside a retirement sum ($192k based on Year 2022) in your Retirement Account. This retirement sum is then used to participate in the CPF LIFE, which will pay out a monthly income for life from age 65.

For more information on CPF LIFE and new changes, please refer to CPF website.

The CPF LIFE Escalating Plan

The CPF LIFE Escalating Plan was launched on 1 Jan 2018.

The initial payout from this plan will be lower as compared to the other two plans. However, the monthly payouts will increase by 2% per year.

This new addition increases the number of CPF LIFE payout options from two to three.

It is mandatory for CPF account holders who have the minimum amount in their Retirement Account to join the scheme*.

*If you have an existing annuity policy, you may be exempted. Read more about Retirement Account exemptions here.

Which CPF LIFE Plan Pays The Most?

Now, let's get down to the juicy part - which plan gives you the most.

You can use CPF LIFE Payout estimator to calculate the projected payout for each plan.

Source: CPF LIFE Payout Estimator

However, the CPF LIFE payout estimator does not show the return in percentage.

As the payout structure for all three plans are different, we will need to compare the returns in percentage to know which is the plan with the highest return.

Potential Returns Across Different CPF LIFE Plans

The comparison was done using the IRR method for males and females at age, 55.

Some assumptions made for the comparison...

For comparison purposes, I use the Internal Rate of Return (IRR) method. This method of calculation takes into account the cash inflow and outflow.

As part of this comparison, there are 2 main variables involved:

- As CPF LIFE pays out a monthly income for as long as the person lives, the return from CPF LIFE is highly dependent on a person’s life span.

- If the person has no dependents, the eventual bequest may become meaningless.

I have included both cases into the comparison in the above table.

Also note: The CPF LIFE payout is just a projection, based on 3.75% and 4.25% return from LIFE Fund. To simplify the calculations, I am using the average payout of 3.75% and 4.25% from the CPF LIFE Payout estimator.

Which CPF LIFE Payout Option Should You Choose?

1) Standard Plan

For a person who believes that he or she can live beyond age 85, the Standard Plan will give a better return.

2) Basic Plan

Basic Plan gives highest return for a person who passes away before 85 years old.

3) Escalating Plan

Returns from Escalating Plan is the lowest unless the person can live beyond age 95.

The Escalating Plan will be better only for people who are not disciplined to save, as there will be more payout in the future.

According to the Department of Statistics, 1 in 3 will live to 90. And hence, you have a good chance for a long life and will need enough cash flow to last through your retirement years.

Should You Put Everything Into CPF LIFE?

Now that we have compared the returns of all 3 CPF LIFE payout options, let's take a look at other aspect of CPF and if you should be putting all your CPF monies into CPF LIFE only.

*These are my opinion, you should do your own due diligence. I've included a list of resources below for you to learn more about CPF, and your options.

- For cases where CPF LIFE generate less than 4% returns, it is better to keep the CPF savings in the retirement account which generates 4% return rather than participating in CPF LIFE

- CPF LIFE is an annuity plan. The premium is paid from CPF savings to participate in LIFE fund which pools all CPF LIFE participants’ premiums. People who live longer benefit more because they will receive more payouts.

Also, CPF LIFE return is higher for a person who participates only with the basic retirement sum. When you double your CPF LIFE participation amount from 96k to 192k, your payout range is not doubled.

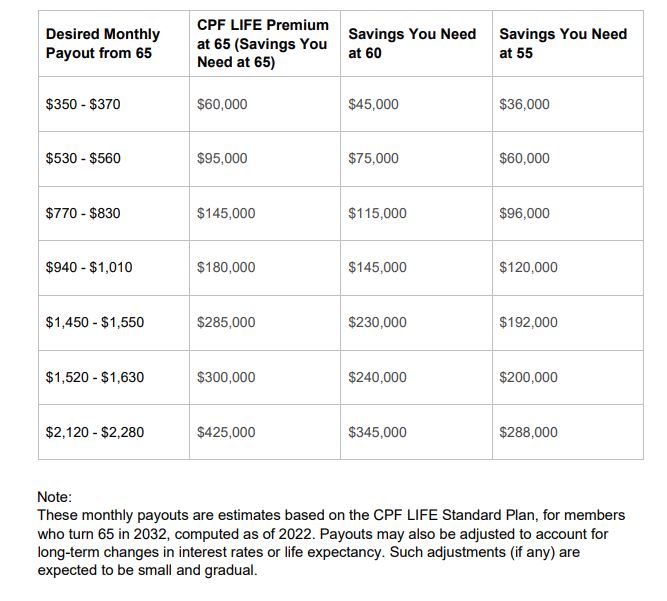

Here's an example given by CPF:

To receive a monthly payout of $1,450 - $1,550, you will need $285,000 in your Retirement Account (RA) at 65. A much lesser sum of $192,000 is required if you set aside the amount in your RA at 55. This is because CPF interest rates of up to 6% will help you grow your savings through compound interest.

Source: CPF

Conclusion

In my opinion, you need to understand the return in percentages rather than just the payout amount to determine which is the best plan to choose.

This is the same for any investments. We should focus on the percentage and not just the absolute amount.

Which Plan Would I Pick For Myself?

I still have some years before reaching 55 but if I have to choose right now, I will pick the Basic Plan.

On top of that, I will pledge my property to reduce my participation in CPF LIFE to fulfill only the basic retirement sum (96k). This is because I can still get 4% from RA or SA.

Plus, I am confident of achieving higher returns from investing.

There is no "best plan" for every individual.

Each of us has different financial circumstances. You should consult the CPF board or a professional advisor to work out a proper retirement plan before making the decision.

More Resources on CPF

Or, you can read up and learn more about CPF and CPF LIFE via these resources:

And if you want to learn how to make your CPF monies grow faster, read these:

The payout is not fixed and will adjust based on interest rate and mortality experience aka death rate.

I would prefer to pledge the property and join Standard plan to maximise my return as average life expectancy is more than 83 for guys and 85 for ladies.

>I would prefer to pledge the property and join Standard plan to maximise my return as average life >expectancy is more than 83 for guys and 85 for ladies.

Can someone to explain why pledging the property and joining the standard plan can help to maximise the return ?

Thanks

“On top of that, I will pledge my property to reduce my participation in CPF LIFE to fulfill only the basic retirement sum (85.5k). This is because I can still get 4% from RA or SA.”

Correct me; once you select the basic plan, you have to withdraw the balance in cash.

Hi,

according to CPF website, you can choose to withdraw the excess in cash or keep it in OA or SA to get the interest. you can refer to the link below:

https://www.cpf.gov.sg/members/schemes/schemes/retirement/retirement-sum-scheme

During my last trip for the CPFL with an officer she said outright transfer to your bank account, cannot go into OA or SA.

“When you reach 55 years old, your Special and/or Ordinary Accounts savings will be transferred to your Retirement Account to form your retirement sum. Your retirement sum can be used to join CPF LIFE which provides you with life-long monthly payout or the Retirement Sum Scheme which provides you with a monthly payout until your Retirement Account balance is depleted.

After setting aside either the Full Retirement Sum or Basic Retirement Sum with sufficient property charge/pledge, you can choose to withdraw the remaining cash balances in your Ordinary and Special Accounts, or continue to keep your savings in CPF to earn attractive interest.”

https://www.cpf.gov.sg/members/schemes/schemes/retirement/retirement-sum-scheme

Hi, I just emailed to CPF board and got their reply as follow:

Dear Mr Koay

Thank you for your enquiry of 30 January 2018.

Upon reaching 55, a CPF Retirement Account (RA) will be created for you. The Board will first set aside your Full Retirement Sum (FRS) [e.g. $171,000] in your RA by transferring funds in the following accounts and sequence:

(i) funds in your Special Account (SA);

(ii) if (i) is insufficient to set aside your FRS in full, funds in the Ordinary Account (OA), will be transferred to your RA to make up your FRS.

Any excess of your FRS will remain in your OA/SA which can be withdrawn. You can also leave the monies in your OA/SA to earn interest until a time you wish to withdraw.

Thereafter, if you own a property with more than 30 years of remaining lease (not a short-lease 2-room Flexi or Enhanced Lease Buyback Scheme flat), you can then choose to set aside the Basic Retirement Sum (BRS) in your RA.

The savings (excluding interest earned in the RA, any government grants received and top-ups made under the Retirement Sum Topping-up Scheme) above your BRS can be withdrawn from your RA, provided you have sufficient CPF property charge or if you pledge your property. The value of the charge is the total amount of CPF savings you used for the property plus the accrued interest that you would have earned on these savings. The charge is considered sufficient if it can restore your FRS when you sell, transfer or otherwise dispose of your property.

Please note that amounts above the BRS will be paid to you in cash when you apply for the RA withdrawal. You would not have the option to leave the amount in your CPF accounts.

Hi Louis

I just had a conversation with CpF Officer today (21/5/2020) and my questions on pledging my property for BRS is as follows

1. I opt for BRS at age 55 with my property which does not use any CpF monies. He said yes the property can be used for pledge even though I paid using cash.

2. Then I sell the property ( anytime after 55) his answer – Then i will have to refund the other half up to FRS to my RA upon sale

3. I buy another property ( let’s say I sold my condo to buy a hdb) after that and pledge it against the FRS again – he said yes it can be done and the monies minus the BRS will be refunded to my OA or I can withdraw cash.

Hence my confusion that the monies in Excess of BHS can only be refunded in cash as stated in the reply you received from CPF

Sometimes I wonder if the officers are on the same page on these issues ?

Or have the policies change over the last 2 years?

hi, you have provided excellent details, clear and concise summary that i hope many will read to benefit. Using IRR % is a better way to express and just what I am looking for to reaffirm my decision made. I have selected BASIC plan since turning 55 about 3 yrs ago, and after reading your summary IRR% table I am totally satisfied with my decision, as I also wanted highest Bequest value when i should expire. My questions are related to SA (after fulfilling max RA requirements – ERS):

a) if you maxed out on RA with ERS (enhanced Retirement SUM) can one still top up SA for additional savings to enjoy the 4% rate?

b) If yes, what is the max LIMIT allowed for topping up SA after maxing out ERS in RA?

c) Are you allowed to withdraw from the SA should need arises some years down the road?

Hi Christie,

Thank you for your feedback, great to hear that the article is useful.

for your question (a) and (b), you cannot top up once your RA hit ERS, you can refer to link below:

https://www.cpf.gov.sg/Members/Schemes/schemes/retirement/retirement-sum-topping-up-scheme

click How much cash top-up or CPF transfer can a recipient receive?

answer for (c) is year, once you hit age 55 and set aside minimum sum, you can withdraw SA as you need.

Basic plan will deduct 10%-20% of RA, while other plans will deduct all RA for CPF life premium.

Consider RA high interest rate 4%, I prefer to option BASIC plan even though monthly payout less a bit (not significant). Additional 2% interest for standard/escalating plan only for the first 60k of combine CPF balance which is also not significant. It’s better leave it maximum on RA and enjoy 4%

>I would prefer to pledge the property and join Standard plan to maximise my return as average life >expectancy is more than 83 for guys and 85 for ladies.

>Can someone to explain why pledging the property and joining the standard plan can help to maximise the return ?

Is it that we leave the rest in our RA account to be used as drawdown instead, earning the 4% interest (CPF-RA)?

Hi,

I am under the Retirement Sum Scheme of $106,000. Understand that this amount will be depleted by 13 to 15 years that will 78 to 80 years old from 65 years. Would it be better to join CPF Life instead. How much do we have to top up etc?

Hi Mrs Han,

you can choose to join CPF LIFE if you want to receive lifetime income. Do note that the payout should be lower as compared to if you don’t join the CPF LIFE.

for how much to top up and how much payout will you recieve, please check with CPF board.

Regards

Louis Koay

Hi Louis,

I understand that the amount of CPF monies utilised towards purchase of flat with accrued interest must be returned to CPF OA upon sale of flat.

I am asking on behalf of my parents. Both of them are already above 65, and are on CPF life payouts. In their case, how do we calculate the amount to return to CPF OA? Or does it even apply if they choose to sell their HDB now?

Hi Eric,

Based on the information on CPF website, you will still need to return the principal and accrued interest that you used for the property purchase. However, you can request for refund as cash if the CPF RA has more than minimum sum. For the amount on CPF life payout, you should check with CPF board. They should provide the updated amount for CPF life

Thanks

Louis

When you choose to pledge my property at 55, you cannot leave extra money in SA account anymore. You can confirm this with CPF.

Hi, the CPF Life Estimator said under the Standard Plan, my payout is between $1293 and $1406.

Anyone reading this will be under the impression that this payout is for life.

But is it ?

According to my mother-in-law, she is getting a total of $1500.

$1000 is from her retirement savings. $500 is from the insurance pool.

And only that $500 is for life.

The $1000… once your savings runs out, that payout will cease.

This is totally different from my reading of CPF Life… that the entire payout ($1293 to $1406) is for life.

But my mother-in-law says that’ s not the case.

Anyone planning to go down cpf talk to an officer please help clarify this point as i am based overseas. tq

Hi hin wah, could it be that your MIL used a bulk of his CPF retirement sum to buy an NTUC annuity in the past and that annuity is for life, while she was also on the Retirement Sum Scheme which gave her monthly payouts till her savings run out.

The best is to check with CPF directly as this is confidential information. You can send your enquiries to CPF via My Mailbox by logging in to CPF website through SingPass, or by sending an enquiry through cpf.gov.sg/writetous.

Hi hin wah,

I hope this reply is better late than none. This is what I feel your MIL was thinking:

1) She was using a nice round number $1500 typical of the elderly.

2) She was also referring to her own principal amount and interest earned separately into $1000 and $500 respectively. And she thought that her own money would run out and then only the interest earned would continue to be paid out. She was being conservative and accrued interest is not simple math.

3) Now, my estimate is that it takes at 10-15 years to withdraw your own CPF savings. Simply add up the monthly payouts over 10 years. For example, $100,000 at a payout of $1,000 x12 months x 10 years = $120,000 (extra $20,000 is interest accrued over 10 years).

4) Simply put, the CPF life scheme only benefit retirees after 65 +10 years later or after 75 years old. What this means to retirees are:

a) How healthy are you to live a blissful life after 75 years old?

b) What you do from age 55 to 65 matters. More and more people only think that money can solve most problems. So a few hundred more at an older age seems to make money sense. How inadequate such thinking is and there is no advice on matters beyond, simply, money. Lots of people continue working from 55, hanging on with medicines and supplements. By 60 the toll on the body shows. And hanging on further from 60-65 with more medicines and supplements means a body worn down and so dependent on the medicines and supplements that a) becomes a big question. So my point is, at 55 the best option is to work-less-exercise & rest-more. So less dependent on medicines. By 60, give yourself an option to stop working or go part-time. This option has to be worked on from age 50. Those who take up housing loans payable up to 70 years old are working for the bank from 55-70 for 15 more years. Those who hang on to the same job after 55, well, many were burdens to the younger colleagues and that is a negative feeling that adds on to aging. From age 60, living on the interest earned from CPF savings until 65 is a viable choice. At this point, lots of people would say, interest from $100-200k in RA at 4% is only $500-1000 a month. Yes, one choice of life is to do a variety of jobs to experience life and earn extra expenses. Half-day work for $1000 a month and live on that till 65. In effect, starting your own cpf life early by 5 years with some manageable work and lots of rest and exercise. Then you are fit for a blissful life after 75. That’s a smart retiree. All figures are minimum and attainable and so would bring ‘more good to more people’. I hope more retirees would not extend their retiring years chasing money blindly and then regret after 65 with more ailments.

Hi,

I am quite confused too and i am reaching 55 in two months time

Shall i withdraw all or ?

As from 55 to 65 .. i do not have the confident …

Hi Delores, we can’t give you an answer as it really depends on your financial situation and needs. You should read up on the implications or get a trusted financial advisor to help you. Louis does 1-to-1 personal consultations.