We have talked previously about how leverage can be used defensively. Chris has additionally spoken about it here and here. We recommend understanding these terms, concepts, and thinking.

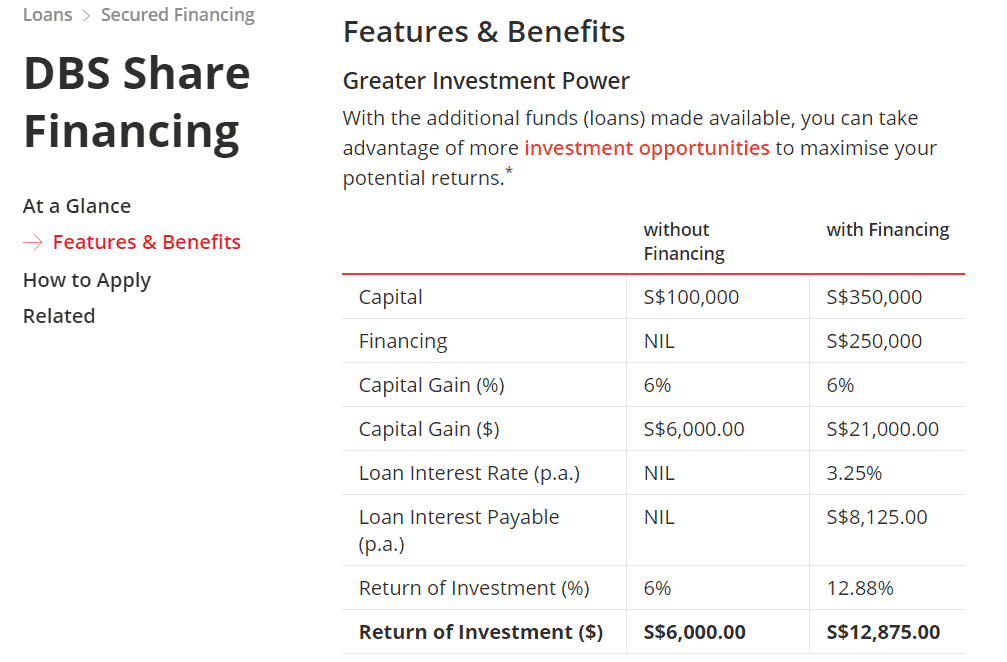

DBS Bank has also illustrated how we can use a leverage account to boost returns. (Note, we don’t borrow more than $1 per every $1 we have to. This is to control the risk of being margin-called, which can destroy up to 60% of your capital.)

Occasionally, investors with a leveraged account can exploit special situations and participate in a unique market opportunity that can lower the investment risk of their portfolios dramatically.

This can potentially reduce the downside risk of a portfolio of REITs even though such risks are already below that of an equivalent equity portfolio that consists of non-REIT counters.

One such opportunity arose recently when Ascendas Hospitality Trust declared that they will be attempting to merge with Ascott Reit.

In what is supposed to be a deal that should conclude before the end of 2019, shareholders in Ascendas Hospitality Trust can expect to exchange one share of AHTrust for $0.0543 in cash and 0.7942 shares in Ascott Reit, then thought to be worth $1.30.

Naturally, when the news arrived, AHTrust shares shot up. When I decided to invest in this piece of news, AHTrust was trading at $1.04.

The price Ascott REIT was trading at was around $1.30 at that time. This meant that if the deal concluded, the value of one share of AHTrust should have been worth (0.0543 + 0.7942 x $1.30) or $1.08676.

Above and beyond its fair price, AHTrust produced $0.0236 in dividends right up till April 2019, so there is a distinct possibility of earning another $0.0236 in December 2019 for a total of $1.08676 + $0.0236 or $1.11.

To be able to pay $1.04 for something that is worth around $1.11 in December 2019 is, on the surface, a 6.7% upside, but considering that the deal is likely to conclude within six months, we can say with confidence that this seems to be a 13.9% return when annualised.

And it does not even end there – a leveraged investor can multiply these gains further.

If an investor were to use an equity multiplier of two and borrow $1 at an interest rate of 3.5% for each $1 of capital they inject into AHTrust, returns can be magnified further to (13.9% x 2) – 3.5%, or, 24.3%!

The logic seemed impeccable to me in July, so I promptly doubled my positions in AHTrust in my leveraged account at $1.04.

Investors should take heed that even though this strategy is called a “merger arbitrage”, it is a not a risk-free bet.

Many things can go wrong and this includes, but is not limited to the following :

- The price of Ascott REIT might drop, leaving you with units worth less in the markets.

- The merger can also fail due to some legal technicality or voter disagreement. There is case law to suggest that if, somehow, the shareholders are not partitioned correctly into proper voting classes before voting for the scheme of the arrangement, judges may decline to allow the merger to take place.

I consider the risk of merger failure to be small and we may even experience some upside from increased tourist arrivals in the short term this Golden Week in China.

At least for me, the move into AHTrust has been sweet so far as it last traded at $1.09. Even better, AHTrust did not experience a big fall during the dreaded Hungry Ghost month reducing the overall shock to my margin account.

Investors can use this as a case study to think about REIT mergers that seem to be increasing in frequency lately as REIT managers take steps to grow bigger so that their REITs can be included in global indices.

Editors notes; All investing comes with risk.

The majority of upside gains in the market are borne by investors who are best able to manage risk. This is a particular feature that is key in all of the courses we run – how to best control capital at risk, whether through in-built qualitative checks or quantitative checks.

In the field of investing, leverage basically means you borrow money from the broker in order to increase the size of your investment. This is not without risk.

The key is to understand HOW to mitigate the risk while setting up to take advantage of the upside.

I would recommend understanding how beta, volatility and semivariance works.

Alternatively, if you find scraping through finance journals painful and you would rather save yourself hours of time, you can sit in and listen to Chris provide a demonstration on how to retire using leverage.

Cheers.