I was invited as a panelist at the recent REITs Symposium and one of the questions stuck with me, it was about the future of office spaces in Singapore.

Before, I was more bearish on office spaces, given that the work-from-home (WFH) phenomenon is challenging the notion of office work. I shared this bearishness during the FB Live with SGX where I also stated that I was bullish on retail.

However, the recent news of Chinese companies setting up Asia Pacific HQ in Singapore is giving me second thoughts about the office space situation in Singapore. (Credits to Jonathan, fellow panelist at REIT Symposium and Director, Research at UOB Kay Hian)

Not all offices are the same – Grade A offices

The “office” sector covers a wide genre of properties. In this post, I’ll focus on Grade A offices in Singapore.

Tenants of Grade A office are usually multi-national companies (MNCs), with a majority being in the finance sector. This delineation is particularly important because the office situation for the small, medium enterprises (SMEs) in Singapore may differ. And, the demand for Grade A offices in Singapore versus overseas may vary.

Hence, the Grade A offices analysis would be more relevant for the following office REITs:

- Capitaland Commercial Trust (SGX:C61U) – 92% income from Singapore

- Suntec REIT (SGX:T82U) – 77% income from Singapore

- Keppel REIT (SGX:K71U) – 74% income from Singapore

- OUE Commercial Trust (SGX:TS0U) – 59% revenue from Singapore office assets

The Good: Office may change but it will not go away

Due to recency bias, we tend to give more weight to recent events and observations and extrapolate it in the future – I’m guilty of this too.

This is especially true today. If we look at the state of office now, they seem to be empty or sparsely occupied. Coupled with observations that:

- people are getting used to working from home and may not want to go back to ‘normal’,

- prudent employers may also see unused office real estate as a waste of resources and would prefer to shrink the space to save cost.

It is easy to assume that this is going to be the ‘new normal’ going forward.

The lingering need for office space

Although it may be true that demand for office space would decline, the concept of office will not be obsolete. There will always be a need for ‘some’ office space, regardless of the various companies’ adoption rate of remote working.

Firstly, a legit business will still require a local office address, especially in the case of MNCs.

Secondly, face-to-face meetings remain essential, especially for sensitive events such as interviews, performance reviews or collaborative sessions like brainstorming or strategic review.

Thirdly, there will always be a group of employees who require a conducive office to work productively. For example, parents who need to get away from their children, white collared employees living in high-density households, etc.

Hence, office is here to stay. The only change is that the demand is likely to go down and office may be redesigned for meetings and hot desking.

I also believed that decentralisation and multi-location of office is likely too. Since the work environment is evolving towards being more flexible, a company may choose to rent smaller offices in multiple locations. This would allow companies to save money as rental in the fringe regions would be lower than in the core central region. And allow its workers to choose a nearby office that would minimise travel.

The Good: Singapore increasingly a neutral place between US and China

I previously wrote about Singapore’s strategy given her unique size and geography. We need to attract MNCs to set up shop here, so that our government can collect taxes. You would notice our government efforts towards achieving this, if you observed carefully – we built a Singapore with good security, trustworthy governance, good infrastructure, educated workforce, a secular modern society and neutrality in foreign affairs.

These are very attractive traits for foreign companies to choose a location for their Asia Pacific headquarters.

In recent years, we have had:

- Google moved into Mapletree Business City II to house 3,000 staff in its Asia Pacific HQ in 2016

- Facebook moved into a 260,000 sqft space across four levels in Marina One in 2018

- Amazon launched Singapore site, the first in Southeast Asia in 2019

- Dyson chose Singapore as a global HQ at St James Power Station in 2019

- Facebook set up its first data centre in Asia for $1 billion at Tanjong Kling, ready in 2022

In addition, here are those who have been around longer:

- Microsoft Asia Pacific headquarters at One Marina Boulevard

- LinkedIn Asia Pacific headquarters at Tower 2 Marina Bay Financial Centre

- Twitter Asia Pacific headquarters at CapitaGreen

Our Unique Role in the Tech Wars

In the examples above, I’ve focused on the tech companies because they would be driving the economy in the foreseeable future. Tech is also a sector where US and China are currently fighting for supremacy. And most importantly, they are expected to have provide the greatest growth in demand for office space in Singapore.

Although we are used to seeing American MNCs in Singapore, but the Chinese tech companies are coming in too. We are able to benefit from both because we appear neutral by not siding with either and this is an advantageous position, as long as we thread carefully.

Here are some high profile Chinese companies making their way into Singapore soon:

- Alibaba acquired half of AXA Tower whereby it is the anchor tenant

- ByteDance to set up Asia HQ in Singapore

- Tencent setting up Southeast Asia HQ in Singapore

Grade A offices have always been rented by financial institutions. This is not surprising, considering that Singapore is a finance hub and that the finance sector was dominant, prior to the rise of tech.

Tech companies have shown their value to society especially during the lockdown and they are expected to grow in the coming decade. We may see an increase in Tech tenants for Grade A offices soon. It could be a case where they simply absorb the office real estate vacated by others.

The Okay: Supply is moderate

New office supply has been moderate since 2018 and the spike is only expected in 2022 (see chart below).

Vacancy has been declining in the past 3 years which suggests that the demand for office space has grown faster than its supply. That said, this trend is based on historical data, we are not sure how it would unfold in the future.

Colliers International projects an increase in vacancy over the next two years.

The 2022 spike in supply would be due to the introduction of 1.9 million sq ft office space contributed by Guoco Midtown and Central Boulevard Towers. Otherwise, supply has been moderate and stable for the other years. Although the supply is known, but the demand remains an unknown.

The Bad: Occupancy rates are dropping

I was looking through the office REITs’ presentations and most of them have reported lower occupancy rates in 2Q2020, right in the midst of Covid-19 impact.

This could mean that a good number of tenants have decided not to renew the leases that were expiring during the pandemic. If that is the sentiment of the rest of the tenants, we may see higher vacancies as leases expire in the future.

At first glance, the situation looks healthy considering that the occupancy rates are maintained at a healthy level of over 90%. However, we must understand that the landlords are currently protected by ongoing leases. We do not know what the renewal rate would be when more leases expire.

Most recently, Capitaland Commercial Trust (SGX:C61U) has reported a drop in occupancy rate to a 7-year low in 2Q2020:

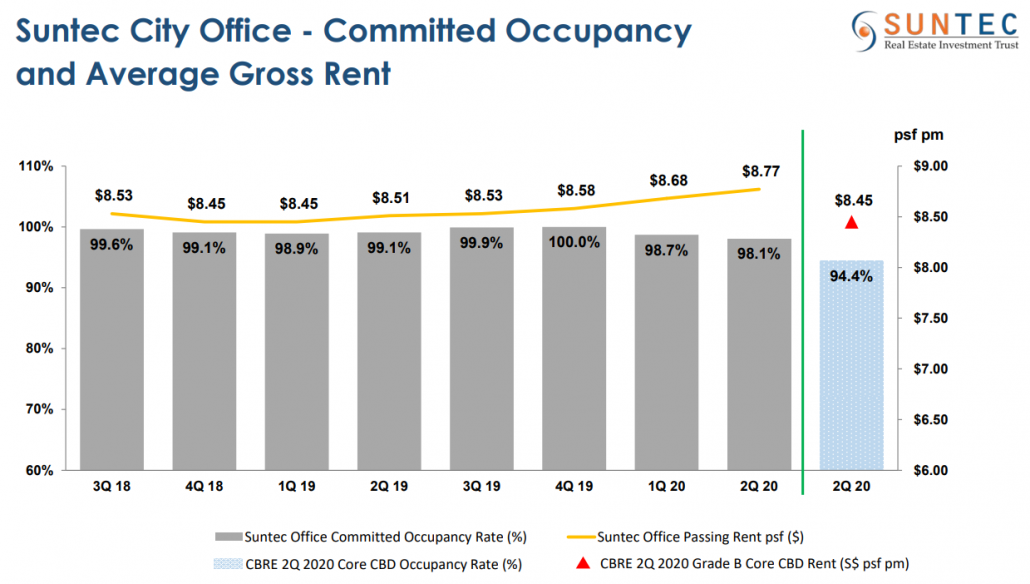

Suntec City Office saw their occupancy rate declined to 98.1%, the lowest in the past 2 years.

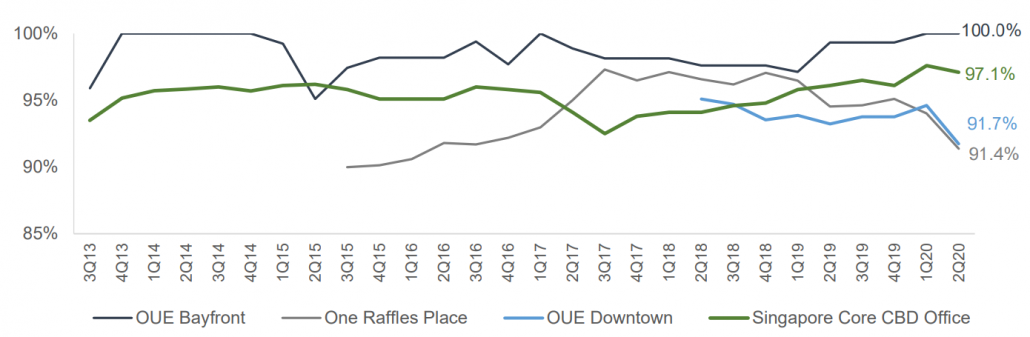

OUE Commercial Trust (SGX:TS0U) saw a sharp drop in its occupancy rate in 2Q2020, specifically for One Raffles Place and OUE Downtown. Both are below the average occupancy rate for Singapore Core CBD office (see chart below). OUE Bayfront was resilient though, maintaining its 100% occupancy.

Summary: Singapore office is far from dead

WFH will inevitably impact the demand for office spaces.

But it will not completely remove the need for a physical office space. It is just more pronounced during this period where companies are advised not to work in office unnecessarily. Once we moved into phase 3, offices would gradually be utilised more frequently.

That said, it is uncertain whether companies would reduce the office space to accommodate flexible working arrangement permanently, or choose to move their office location further from the city centre to save costs. These may be long term trends that could affect the core CBD office rental rates.

Another cause for worry is the recent decline in occupancy rates. I am not sure if this trend will be persistent in future renewals, or if the worst is already behind us.

Lastly, office will do well as long as Singapore remains as an attractive regional HQ for MNCs.

Betting on office REITs is akin to betting on the ability of the Singapore government to remain neutral in foreign affairs while providing a good infrastructure, an educated workforce and security. If you are confident in our ability to do so, consider betting on Singapore office REITs for the long term.

“the recent news of Chinese companies setting up Asia Pacific HQ in Singapore is giving me second thoughts about the office space situation in Singapore.” Do we know how many officers are coming and the floor area they need in S’pore?

No specifics disclosed yet. I don’t expect to be huge at first. Saw about 100 jobs posted by Tencent in Singapore. Compared to FB which secured a 200,000 sq ft space to accommodate 3,000. That said, I expect the numbers to keep going up. And not just the Chinese. Tesla is reported to have a presence in Singapore too. So the tech companies can absorb some of the space left by the existing tenants.