It doesn’t help to be in U.S. hospitality business now considering Covid-19 is halting travels and the virus spreading to the U.S. To make things worse, the oil price plunging on 9 Mar 2020 spooked the entire market and ARA US HTrust plunged by more than 20% in a day. It opened 7% down on the next day and the markets are still moving wildly at the point of writing.

What do the fundamentals say? Is the market over-reacting?

Backdrop for REITs

With a favourable tax regime, strong regulatory corporate governance framework and an ecosystem of well established property developers looking to build their asset management platform, Singapore has now transformed into a well regarded regional hub for REITS, with nearly 50 REITS, and having a total market capitalisation of almost SGD 100bil. There are also now a variety of REITS spanning many industries and geographic regions.

A low interest rate environment coupled with a relatively benign macroeconomic situation has enabled most REITS to expand their asset base via acquisitions of stabilised assets while maintaining key ratios. With valuations compressing across the developed economies, Sponsors have also taken this as an opportunity to monetise stable assets into the REIT platform. As such, we have seen gearing ratios of REITs increase from a low 30% average to a near 40% average.

With uncertainty arising from the recent virus outbreak situation and an economy that many deem to be near the peak of cycle, there is mild risk to downward rental reversion across many industries should there be an economic slowdown.

Consequently, we expect a prolonged low interest rate environment, allowing REITS to continue to be able to refinance their borrowings at lower costs which should help mitigate declining revenues. However there are refinancing and funding risks if market conditions tighten and turn volatile.

REITs have also been faced with lower distributable income in the recent quarters. They have mitigated this by reaching into their retained profits, declaring capital distributions, thus ensuring distributions are not significantly reduced. We caution that this is effectively special dividends in non-REIT speak.

The mergers in recent quarters also allows REIT to undertake larger developments, thus elevating their risk profile slightly for higher margins.

With this, we present ARA US Hospitality Trust; a new REIT that we think has a long runway, high DPU and also an opportunity to enter at a favourable valuation.

ARA US HTrust Background

1. Background

ARA US Hospitality Trust (The Trust) is a Singapore-listed REIT listed on the Mainboard of the Singapore Exchange on 9 May 2019 at US$0.88. The Trust is the first pure-play U.S. upscale select-service hospitality trust listed in Asia. The share price was US$0.51 at the time of writing, and was trading below the NAV of US$0.87.

The Trust is established with the mandate of investing in a portfolio of income-producing real estate primarily for hospitality and/or hospitality-related purposes, located in the U.S.

ARA US Hospitality Trust’s initial portfolio consists of 38 Hyatt-branded hotels with 4,950 guest rooms located throughout 21 states. The 38 hotels include 27 Hyatt Place and 11 Hyatt House.

Following the completion of the Acquisition on 17 January 2020, The Trust acquire a portfolio of three Marriott-branded upscale select-service hotels in the United States for US$84.5 million. The three freehold properties are located within the markets of Raleigh, North Carolina and San Antonio, Texas, that benefit from diversified demand from nearby corporations, universities and leisure attractions. The acquisition was primarily with debt and by internal cash resources. Following this acquisition, ARA H-Trust’s portfolio now has 41 hotels with 5,340 guest rooms geographically diversified throughout 22 states in the United States.

The accretive acquisition at a net property income yield of 8.0% is expected to increase ARA H-Trust’s pro forma distribution income by 8.1%. With the completion of this acquisition, the gearing ratio is now 38%.

Financials

| US$’000 | Actual 4Q19 | Forecast 4Q19 | Change % |

| Gross Income | 39,292 | 44,772 | -12.2% |

| Net Property Income | 9,232 | 13,752 | -32.9% |

| Distributable Income | 6,109 | 7,016 | -12.9% |

| Distribution per Security (US cents) | 1.08 | 1.24 | -12.9% |

| US$’000 | Actual FY19 | Forecast FY19 | Change % |

| Gross Income | 114,952 | 124,857 | -7.9% |

| Net Property Income | 32,598 | 40,899 | -20.3% |

| Distributable Income | 23,963 | 25,840 | -7.7% |

| Distribution per Security (US cents) | 4.21 | 4.56 | -7.7% |

We have noticed listed US Hospitality trusts have been underperforming in 4Q19 and FY19 as compared to their forecasts. This is mainly due to the timing of IPO which was during market favourable conditions and typically at near peak valuations. This has led to a decline in investment property values at the balance sheet date. ARA US Trust’s carrying value of investment properties declined by about 2.6% or $19m due to poorer than expected performance in these properties.

As such, we prefer to look at actual performance vs index to measure the Trust’s performance. Looking at snapshot below, we can see that the Hyatt House branded assets have significantly outperform both in occupancy and RevPAR as compared to the Hyatt Place which has opportunity to improve. (To read the figures, 106.3% RevPAR index means just 1.063x of the average.)

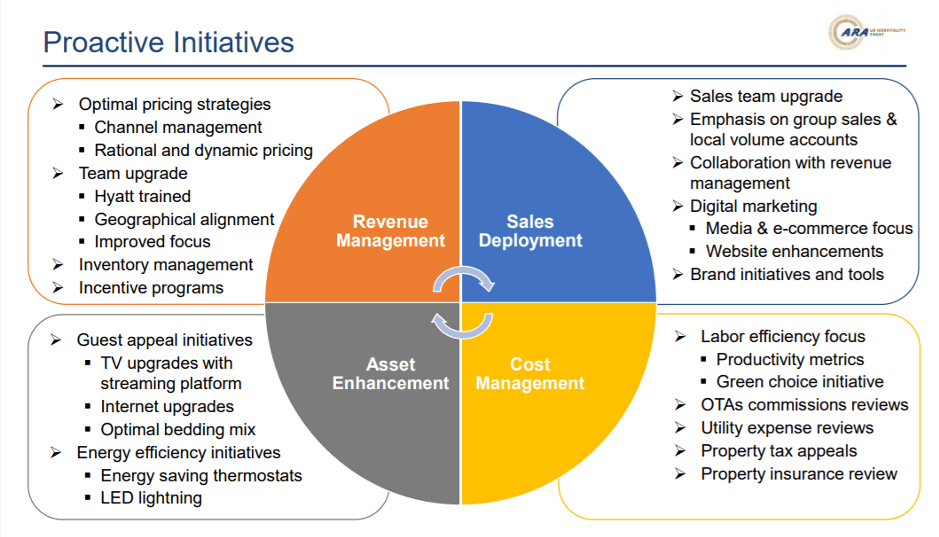

The management has also came up with a laundry list of initiatives to drive both the top line and bottom line figures and this is where unitholders will have some relief that the management is proactive to improve things. But unitholders will have to review future results to identify if the Trust has delivered on its target.

The annualised DPS yield based on IPO price of US$0.88 was US$0.065 or 7.4% which is lower than the forecast yield of US$0.07 or 8%.

Investment thesis

(i) Strong sponsor with growth plans

The Trust is externally managed by ARA Asset Management Limited (ARA), a premier global integrated real assets fund manager headquartered in Singapore. As at 30 June 2019, the gross assets managed by ARA Group and its associates is over S$83 billion across 23 countries. ARA has a 30+% stake in The Trust.

Besides ARA US Hospitality Trust, ARA Group directly manages these five listed real estate investment trusts:

And indirectly manages listed real estate investment trusts in Singapore, Malaysia, Japan and Australia through associate companies.

The Group also manages private funds providing investment opportunities in diverse real estate sectors and geographies that cater to different investor risk appetites.

Therefore, this is a REIT with a large sponsor and with a property management team that has the relevant experience.

(ii) Lease structure

For ARA US Hospitality Trust, the rent is 100% variable and The Trust also bears all of such costs. This means unitholders are heavily reliant on not only the competency of the REIT managers and also the macroeconomic climate which is a key driver of both occupancy rates and RevPAR.

We do not believe that a variable structure is worse off than a fixed income structure for the sole reason that any contract can be renegotiated. In the current Covid-19 outbreak and the previous SARS outbreak, it is prevalent to see tenants defaulting or reaching out to landlords to obtain rent relief in some form.

In fact, we prefer a variable rent structure as we do not think a fixed rent structure offers much protection in a downcycle anyway.

In addition, The Trust has all but 2 properties have Freehold land titles as is common in the USA.

(iii) Debt profile and funding

Post acquisition, we expect The Trust to have about US$323m in loans at a funding cost of nearly 4%. This represents interest expense of nearly $13m a year. No loans are due within one year, therefore there is no immediate concern on repayment or availability of funding/refinancing in the current weakening macroeconomic conditions.

The Trust has initiated a multicurrency stapled debt issuance programme and we expect them to start utilising this programme soon. A 0.25% savings on funding cost will lead to $0.8m in savings representing additional DPU of 1.9%.

On 4 March 2020, the FOMC enacted a emergency rate cut of 0.5% which will lower the interest expense cost.

We expect further interest rate cuts by the US Federal Reserve will help support The Trust to gear up and carrying out acquisitions.

(iv) Acquisition headroom

We note that the current gearing ratio of 38%. We estimate that The Trust is able to acquire another US$250m of assets to gear up to 43%. However, this will require them to raise US$100 in equity, which can be easily achieve via a partial private placement and partial equity fund raising with all shareholders. The total estimated DPU accretion would be 1.6%. Given the low DPU accretion, it is likely The Trust will try to use a higher debt funding mix in each acquisition to increase the DPU accretion to shareholders. As mentioned in point (iii), lower cost of funding will also increase the DPU accretion arising from acquisitions.

(v) Hospitality industry

The US hospitality industry is underpinned by the current state of the US economy which has moderate GDP growth, high consumer spending and high consumer confidence.

Since 2010, demand growth has consistently outpaced supply growth in the U.S. lodging market, resulting in nine consecutive years of RevPAR growth as of 2018. While RevPAR growth decelerated to +2.9% in 2017 and +2.9% in 2018 following CAGR of +6.6% between 2010 and 2015, RevPAR growth is expected to remain positive going forward. During the next few years, it is expected that the US economic expansion will continue to support growth in lodging demand, while lodging supply growth is expected to slow down. Consequently, RevPAR is projected to grow at a slower pace of CAGR of 1.8% between 2019 and 2022.

Major risk factors

(i) Funding and Interest rate risks

As a REIT, there is always a risk of the REIT’s ability to secure refinancing and at favourable terms and conditions. Even in a low interest rate environment, the cost of funding increases when market volatility increases due to risks surfacing. The cost of funding can increase by 2% or more in such conditions. If the REIT’s credit profile declines, the floor cost of funding increases accordingly as well.

(ii) Macroeconomic headwinds

With the slowing macroeconomic conditions, If both business travel and consumer spending declines, the hospitality industry will be affected significantly.

International tourism arising from China into the USA has been affected due to the COVID-19 virus and also the trade war which reduced Chinese interest in travelling to the USA.

Conclusion

With the current macroeconomic headwinds and COVID-19 virus, we think an opportunity may surface to purchase this stock if the virus situation extends. The current expectation (which is in a constant state of flux) is for green shoots of a turnaround in late Q2 and likely reflective only in Q3.

The target price of US$1.01, providing a yield of 6.5% is heavily reliant on not only the Trust maintaining its current performance but also rate cuts, thus maintaining a 5.25% yield premium over the current US fed fund rate of 1.25%.

We believe a good entry price would be around US$0.51 (Yield of 12.7%) (P/B of 0.58) while an exit at US$1.01 (Yield of 6.5%) (P/B of 1.16) would be desirable.

These views are of the author and not to be taken as investment advice or recommendation. The author has no position in this counter but may include the possibility to enter in the future.