Finally! Singaporeans can enjoy some liberation as more activities have resumed during Phase 2. I did a thought experiment to run through the list of SGX-listed stocks to see which companies could potentially benefit from this reopening.

Please note that this is my subjective view and you may disagree with me. Nonetheless, it was fun to think through this and I hope you are able to get a wider perspective or even explore some trade ideas from here. Enjoy!

Heartland Malls: Frasers Centrepoint (SGX:J69U) and CapitaMall Trust (SGX:C38U)

Most of the mall outlets were closed during the Circuit Breaker period and Frasers Centrepoint (FCT) reported a drop in shopper traffic by as much as 68.3%.

Singaporeans have been turning to e-commerce for retail therapy during the Circuit Breaker period. But nothing beats leaving the house to take a walk in the malls since they are now open for business. I picked Frasers Centrepoint Trust and CapitaMall Trust because they have heartland malls which are located closer to homes. Singaporeans want to go out but I don’t think many of them would want to travel further to the city area. Thus, I didn’t include Suntec REIT (SGX:TE8U) and Lendlease REIT (SGX:JYEU). Moreover, tourists wouldn’t be back so soon to visit the malls in the city.

The stock market doesn’t seem to agree with me. Lendlease REIT gained most by 38% from its low (3 Apr 2020), which is higher than Frasers Centrepoint (+32%), CapitaMall Trust (+23%) and Suntec REIT (+19%). It might be because of the news that Lendlease REIT had won a tender to develop the Grange road carpark into an event space.

Surprisingly, FCT has reported higher revenue by 0.9% in 2Q2020 compared to the same quarter last year. This was due to rental renewal and step up rents from existing tenants. But with the rental rebates extended to the tenants, the net property income became lower by 1.3%. FCT also decided to retain 50% of the dividends and gave out $0.0161 in 2Q2020, which is 49% lower than what was given in the same quarter last year. The Trust enjoyed a high 96.1% portfolio occupancy as at 31 March 2020. The 1H2020 results didn’t show much impact by Covid-19 and yet the share price is still trading below pre-Covid levels.

CapitaMall Trust did not publish any 2Q2020 results at the point of writing. It is also pending a merger with Capitaland Commercial Trust.

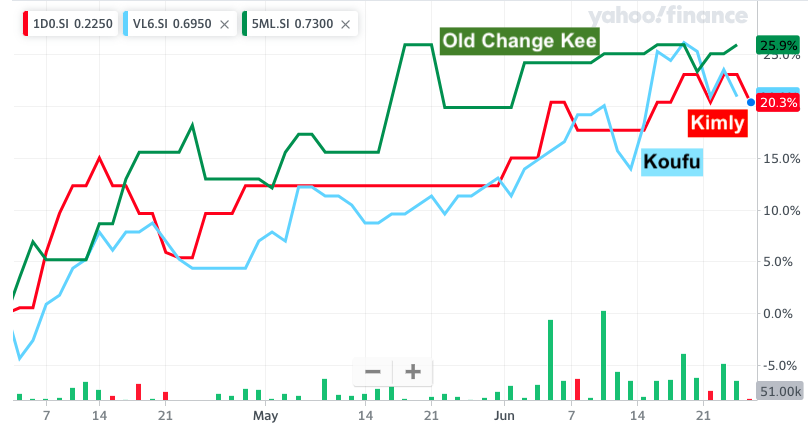

Food Staples: Kimly (SGX:1D0), Koufu (VL6) and Old Change Kee (SGX:5ML)

Singaporeans love to eat but don’t like to cook. Eating out at coffeeshops and foodcourts is the easy way out and yet affordable to do it daily. Most of these food stalls remained open during Circuit Breaker for takeaways. However, I was told by one of the stall operators that they still see a dip in sales nonetheless. Koufu has projected a 15% drop in revenue in the first half of 2020. Phase 2 would allow dining on site and these food establishments should see more customers coming back.

I expect coffeeshop and food court operators such as Kimly and Koufu to benefit. In fact, Kimly took the opportunity to expand by acquiring 6 food outlets for S$35.5 million during this pandemic. The acquisition was paid in cash (S$30 million) and shares (S$5.5 million).

Koufu seemed to have suffered more as they have exposure to schools (Singapore Polytechnic, ITE, Ngee Ann Polytechnic and SMU) and touristy areas (Marina Bay Sands) which would not see any footfall as tertiary level students are on home-based learning and there are no tourists to speak of. The Group has suspended the operations of 10 food courts, 3 quick-service restaurants and 2 full-service restaurants during the circuit breaker period. But they should gradually get back to business in Phase 2.

Old Chang Kee had to temporarily close 22 stores out of the 89 in Singapore. These are mainly located in touristy areas or parks. But the Group has also done more catering for dormitories, hospitals and charities, which offset some of the loss in retail sales. Hence, I sensed that Old Chang Kee is operating pretty normally during Covid-19, especially when the management didn’t quantify any losses. The share price of Old Chang Kee has also recovered to pre-Covid level.

The shares of Old Chang Kee, Koufu and Kimly have gained 26%, 20% and 20% from their lows on 3 Apr 2020 respectively.

I don’t expect their businesses to be affected by a large degree and hence the historical financial metrics would remain as good references. However, we should expect lower dividends as companies seek to conserve cash, thereby affecting the dividend yield. For example, Kimly has cut dividends by 50% during its mid-year distribution (31 Mar 2020). So take the historical dividend yield with a pinch of salt.

| Kimly (Sep 2019) | Koufu (Dec 2019) | Old Change Kee (Mar 2020) | |

| PE ratio | 13 | 14 | 25 |

| Div Yield | 5.9% | 3.6% | 4.1% |

Casual Dining: ABR (SGX:533) and RE&S (SGX:1G1)

With dining-in allowed, I would expect casual dining restaurants such as Swensen’s (ABR is the parent company) and Ichiban Sushi (RE&S is the parent company) to recover part of their revenue. Unlike the coffeshops and food courts, these restaurants would have taken a bigger hit during Circuit Breaker because takeaways aren’t as popular as dining-in. But a full revenue recovery would not be possible given that the restaurants can only take in half the capacity.

I have excluded Sakae, Soup Restaurant, No Signboard and Jumbo because I believe they would recover less than ABR and RE&S. First, Sakae and Soup Restaurant aren’t as popular which are evident in their low annual revenue of over S$40m. Second, No Signboard and Jumbo are likelier to cater to big gatherings, which is not possible under the safe distancing requirements in Phase 2.

RE&S reported a 15% drop in revenue during the first 3 months of 2020. We should expect the sales to worsen for the Apr-Jun period before seeing recovery in the second half of 2020. ABR has yet to report any quarterly or half-yearly results. I think that restaurants are the weaker lot in this list because I really don’t see the possibility of a full recovery to pre-Covid levels in the near future.

ABR and RE&S share prices are still lower than pre-Covid trading. RE&S made a low of $0.065 on 19 May 2020 and has since gained 32%. ABR, on the other hand, is still trading at its low in 2020.

Retail Shops: Challenger (SGX:573), SK Jewellery (SGX:42G) and MoneyMax (SGX:5WJ)

One of the most popular IT gadget shops, Challenger, was not able to open during Circuit Breaker. Challenger operates an online store called Hatchi.tech which saw increased sales during Circuit Breaker, but the sales wasn’t sufficient to cover the loss of business in the retail segment. The management said that they expect 1H2020 to be positive due to sales made prior to Circuit Breaker as well as the financial support from the government.

SK Jewellery issued a profit guidance statement, saying that a loss is expected for 1H2020 due to the temporary closure of the stores. They tried to increase their selling efforts online via e-commerce platforms such as Lazada and Shopee but I think it is too competitive and jewellery is something that I would prefer to view and even hold it physically before committing a purchase.

But SK Jewellery should do well on the back of a rising gold market. Gold has hit a 5 year high. With unlimited Quantitative Easing, we can expect USD to weaken and gold should continue to do well. With the reopening of the stores, we can expect to see some gold rush as higher prices begets more buying.

The not-so-good news is that I would expect more customers pawning their valuables. This is because the economy is going to get worse and we would see more retrenchments when the government’s Job Support Scheme ends. Those who have financial difficulties would look to pawn their items for cash. MoneyMax should be able to benefit from the rise in pawning activities. Since they would also hold an inventory of gold jewellery, they may attract gold buyers to purchase these pawned items, thereby increasing their revenue and profits.

SK Jewellery has gained 41% from its low on 3 Apr 2020, while MoneyMax and Challenger gained 23% and 11% respectively over the same period.

Services: Q & M Dental (SGX:QC7) and Mindchamps (SGX:CNE)

I wanted to go for my regular dental checkups but couldn’t because the clinics were only allowed to take emergency cases. Hence, I suppose many dental clinics were idling without much business during Circuit Breaker. However, Q & M staff made themselves useful – more than 90 of them have swabbed 14,000 foreign workers voluntarily.

I made a booking with a dental clinic at the start of Phase 2 but could only get a slot in Jul. Although I didn’t go for Q & M Dental, I believe many others do and the clinics should have a backlog of customers to attend to. We should see better financial performance in the second half of 2020.

I pulled out my kid from childcare as I feared the possibility of an infection. So I kept him at home and he was bothering me while I worked. I was also guilty at times for working too much and not spending enough time to teach him. With the situation getting better, I can’t wait to send him back to school so I can get some peace for work and he gets to learn stuffs from the teachers. I believe many parents could relate to this and might even share the same idea. This should be good news for Mindchamps as they could see a rise in enrolments. Moreover, they have enrichment classes for the older kids and tuition is allowed in Phase 2. Mindchamps is back in business.

Mindchamps and Q & M Dental have gained 21% and 12% since 19 Mar 2020 respectively.

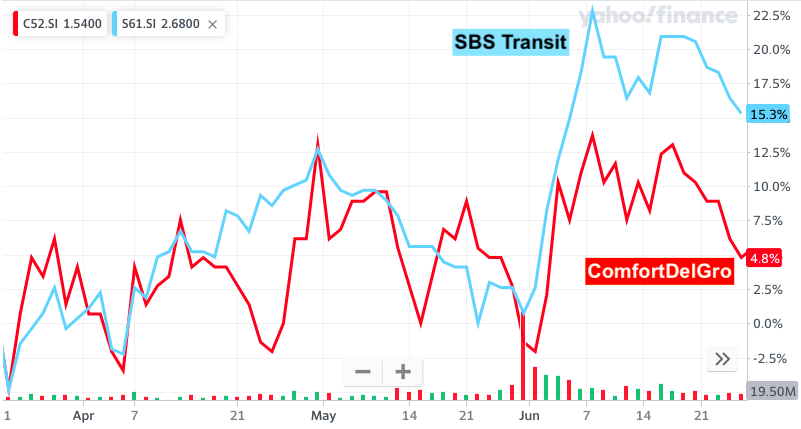

Transport: ComfortDelGro (SGX:C52) [inclusive of SBS Transit (SGX:S61) and VICOM (SGX:WJP)]

SBS Transit saw a 80% drop in ridership during Circuit Breaker. It was worse than my expectation of around 60-70%.

As more people get back to work in the office, we should see a rise in ridership in our transport system. ComfortDelGro should recover a part of their loss revenue from trains, buses and taxis. The improvement is evident when the alternate seating arrangements were abolished in public transport in order to accommodate more passengers. I have also noticed that the number of taxis queuing for customers has approximately halved. Things are getting better but don’t expect a full recovery.

ComfortDelGro has dished out S$116 million in rental rebates to the taxi drivers and incurring large losses in the taxi segment. The management sees the impact of Covid-19 as many-fold worse than SARS but they opined that ComfortDelGro could not waive rental indefinitely. Hence new initatives like the ComfortDelivery App was introduced to help drivers with another income source by delivering food.

As for VICOM, the inspection for goods vehicles, buses, taxis, private-hire cars, motorcycles inspections continued during Circuit Breaker. Personal cars were allowed to postpone the inspection. I received a message to do it in July. This means that VICOM would see a backlog of vehicle inspections. They might even get a bump in revenue as previous quarters’ revenue may squeeze into Q3 and Q4 in 2020.

VICOM recently went for a 1-for-4 stock split. Usually this is a good sign because the share price has risen too much and has become ‘unaffordable’. The management decided to split it and bring down the share price.

SBS Transit and ComfortDelGro have gained 15% and 5% respectively since 23 Mar 2020.

Real Estate: PropNex (SGX:OYY) and APAC Realty (SGX:CLN)

The real estate agents had it rough during Circuit Breaker as property viewing wasn’t allowed. Although there were deals being closed, most buyers wouldn’t commit without viewing the properties. Moreover, property purchase is a high ticket item which one would not make a decision lightly.

As a result, developers sold only 277 new private homes in Apr 2020, a drop by 62.4% compared to Apr 2019. The number of condominiums and private apartments resold in May 2020 dived 80% when compared with the figures in May 2019. The number of HDB flats resold in May 2020 was just 364 units, making it the lowest monthly resale volume since 1990.

Property viewing is allowed in Phase 2. The transaction activity should gradually come back and real estate agents should start earning their keep again. PropNex and APAC Realty are the top two real estate agencies in Singapore and we should see better numbers in the second half of 2020.

The stock market agrees as both stocks have gradually rose since their lows made on 23 Mar 2020. APAC Realty and PropNex have gained 21% and 20% respectively.

See our take on PropNex vs APAC Realty

Cleaning: Colex (SGX:567)

We will see more cleaning and disinfections carried out in public spaces and in the office. Commercial cleaning services would be in high demand. Colex is a waste disposal business but it also has a cleaning service. In fact, the cleaning service is a more profitable business registering a 9% profit margin, compared to a mere 1% profit margin for the waste disposal segment. A rise in contract cleaning revenue should increase the overall profitability of Colex.

Colex has gained 14% since 16 Mar 2020.

Conclusion

Thank you for reading all the way to the end. So here you are. I have identified 16 Singapore stocks that can potentially benefit from the Phase 2 reopening. In summary, heartland malls, coffeeshop and food court operators, dental and childcare services, certain retail outlets, public transport, real estate agencies, and cleaning services, should report better results in 1H2020. You may agree or disagree and you can leave your thoughts in the comments below. Most importantly, I hope it has trigger some trade ideas for you!

Hi Alvin,

Appreciate your summary.

Thank you

David